Hokusai’s The Great Wave Off Kanagawa (神奈川沖浪裏) has famously been described as “the most reproduced image in the history of all art” and is attributed with inspiring Western artists and musicians from Van Gogh and Monet to Debussy through, amongst other things, the unanswered questions embedded in the imagery. Is there a terrifying storm occurring or simply a wave breaking against a clear sky? Are the fast barges being buffeted by the waves and are the sailors in peril, or are they master oarsmen timing the swells to their advantage?

Recent conversations with asset owners have brought this debate to mind, as many are not sure what to make of Japan’s stellar performance over the last two years. Those who have been invested had some of their gains eroded by the feeble Yen, others have sought cheap companies but have ended up stuck in value traps, while some have enjoyed returns that have out-paced MSCI World, MSCI World Small and a certain Mr. Buffett[1]. Is it really different this time? Does the corporate governance wave have further to rise? Can this once-in-a-generation shift in corporate Japan be navigated? Do attractive opportunities still exist and if so, can they actually be found?

Emphatically, yes.

The most straightforward question to answer is whether Japan is really changing. We would argue not only that it is already, irrevocably transformed, but that we are only at the beginning of a sea-change in corporate culture which will have long-term and far-reaching impact on the Japanese market.

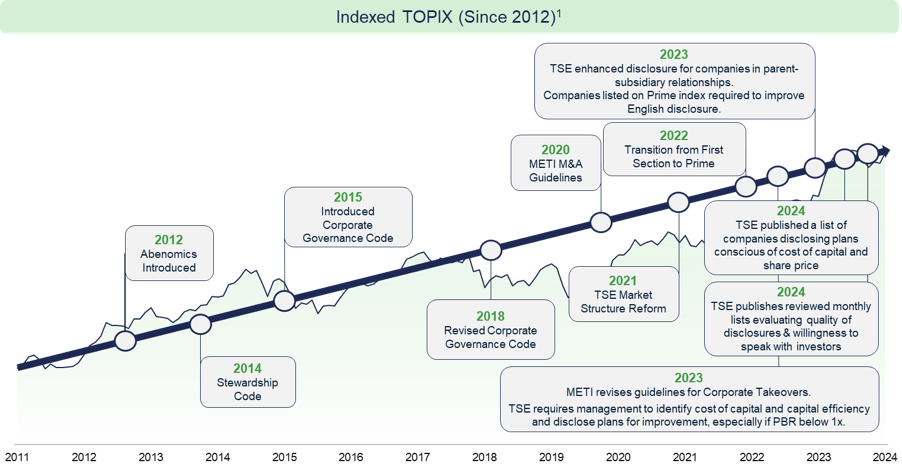

Although Corporate Governance reform famously formed late Prime Minister Abe’s third arrow, the initial rumblings of change have taken over a decade to not only gain momentum, but to begin to be recognised by foreign investors. Isolated headlines over time have made way for almost weekly highlights in the form of buybacks, cross-shareholding unwinds, better shareholder disclosure, and corporate events. Some Japan-watchers will have dismissed claims of permanent and meaningful developments as a ripple rather than a wave of change, and protest that we have seen investors be excited, and then disappointed, before. We would argue instead, that perhaps the main reason why “it’s different this time”, is that the pressure on corporate Japan to change isn’t a result of foreign Barbarians at the Gate[2]. Instead, the forces being applied are stemming from Japan itself.

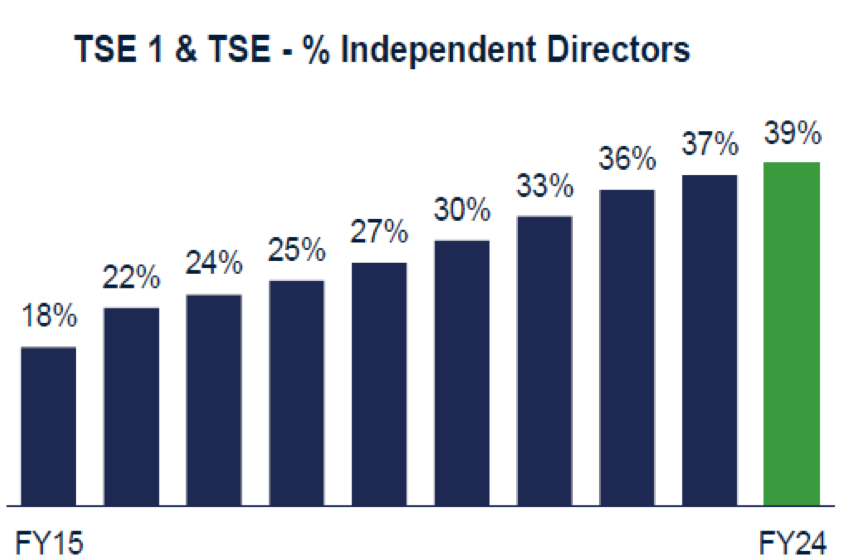

Abe’s lasting legacy has been supported and cemented by a truly extraordinary coordinated and orchestrated effort from the Tokyo Stock Exchange (TSE), the Government, the Bank of Japan, and large domestic asset owners to drive change. The TSE’s “name and shame[1]” list of companies who are and, more importantly, who are not taking measures to improve their valuations, is all the more astonishing because it was implemented by a Japanese regulator. This measure alone brought 50% of Japan’s c.4,000 listed companies who are trading below 1x PBR[2] firmly into the TSE’s crosshairs. On a recent visit to our offices, TSE representatives assured us that they will continue to adjust and amend measures to bring about positive change in 2025.

Not all heroes wear capes

In another power move, the Ministry of Economy, Trade and Industry (METI) released guidelines to promote corporate takeovers in 2023, stressing that credible takeover offers must be considered and can’t simply be dismissed. Since then, a number of high-profile unsolicited takeover bids have been launched (e.g. Nidec and Makino Milling, Bain and KKR for Fuji Soft).

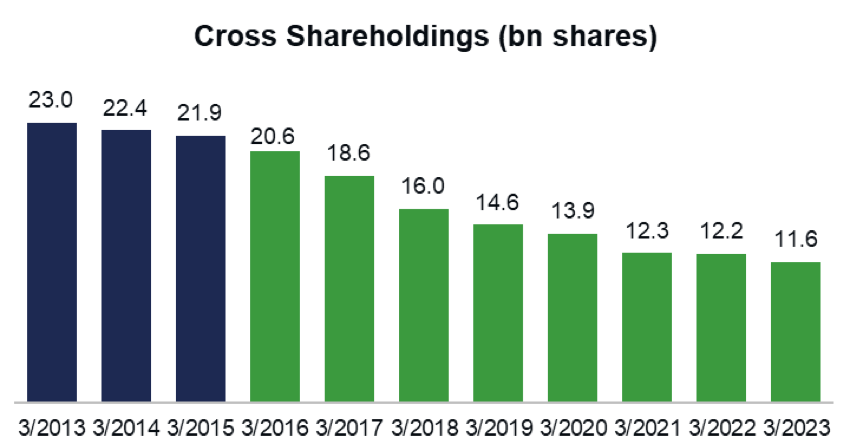

The results of corporate governance reform are irrefutable and have been making international headlines, with household names like Hitachi, Mitsubishi Electric and Fujitsu announcing cross-shareholding unwinds, activism activity coming to the fore and buy-back levels hitting historical highs. In a recent remarkable move, the stalwart of Japan Inc, Toyota Motor, unexpectedly committed to unwinding their cross-shareholdings and doubling their ROE to 20%[1] (vs 9% market average).

Toyota’s uncharacteristic and much-welcomed commitments are reflective of changes happening across the market, with evidence clearly indicating that Japan has crossed a veritable Rubicon in terms of corporate attitudes. What is also clear, however, is that there is still a long way to go. That is especially true in the world of small-mid caps, which make up 65% of the Japan universe[2].

The average large cap company in Japan has 12 analysts covering them, whereas the average small-cap company has 0-1[3]. Small-cap companies in Japan are also notorious for their weak or utterly lacking shareholder communication in Japanese, let alone English. Alongside their infamously overcapitalised balance sheets, this lack of coverage, knowledge and access to the small-cap universe is part of the reason why companies trade at a significant discount to their Japanese and global peers and why they are such an attractively inefficient hunting ground for those who do the work.

The case for small-caps has been compelling for some time, but as with the broader market, there lacked a catalyst to spur these companies into action. Many a wary investor has been lured by the promise of cheap, high-quality companies with bounties of cash and assets on their balance sheets, and left Japan disillusioned and disappointed. Now though, it is not just one catalyst creating waves in Japan, it is many.

Together, the reforms being encouraged across Japan’s regulatory establishments are pushing and moulding corporate Japan into a shape that is more familiar and accessible to foreign investors, enabling a reassessment of what Japan’s market can offer. Where else in the world can you find a market so broad and so deep, so well-capitalised and so under-owned? According to global private equity companies, nowhere else. As the co-founder of KKR stated in a recent interview, “If I were 30 years old today and I could speak Japanese, I’d go to Japan[4]”.

Private equity’s interest hasn’t appeared overnight. Over the last few years, large global players have opened offices in Tokyo and have been researching and assessing the market, waiting for the corporate governance seeds sown over a decade ago to bear fruit. At the same time, smaller domestic firms have been established and are contributing to an increasingly healthy and sophisticated private equity industry. In 2024, takeover bids in Japan hit an 18-year high and we have felt this pick-up in activity at a strategy level, with four of our portfolio companies bought out over the year.

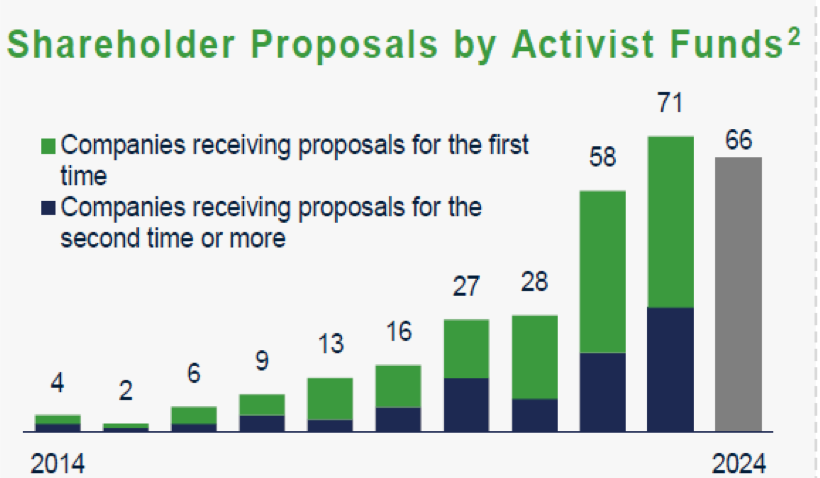

The acceleration felt within private equity is a direct result of engagement and activism momentum building, which in turn has driven change at corporate management level across the market. The post-war keiretsu spider’s web of cross-shareholdings have acted as pseudo-poison pills for decades, protecting listed subsidiaries and preferred business partners from acquisition. Large unwinds from some of the household conglomerate names have been effective at almost halving the amount of cross-shareholding tie-ups since the corporate governance code was introduced in 2015[5].

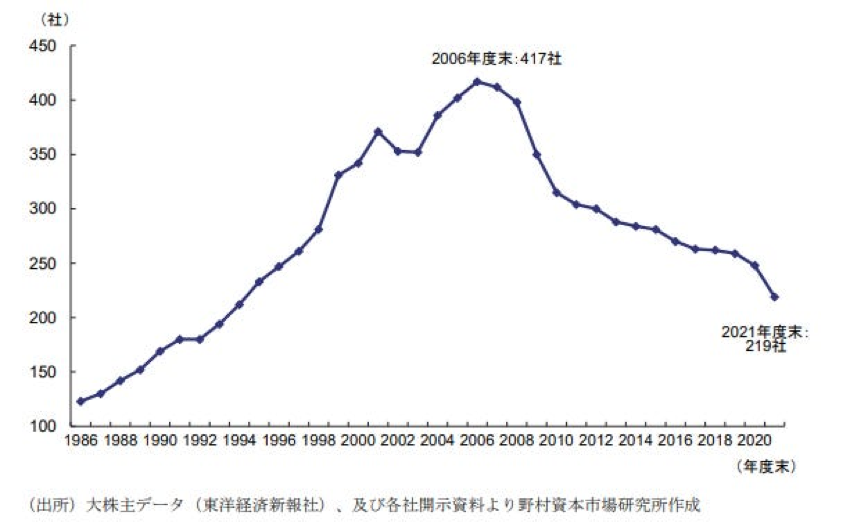

Parent-child subsidiaries are another area of focus for the TSE where they are making solid progress. Listed subsidiaries often exist purely for the convenience of the parent company, and will have limited, if any, pricing power or real agency over business strategy. The number of parent-child subsidiaries peaked at 407 in 2006 and has since steadily dropped to 219 in 2024[1]. The Alps Logistics buyout in 2024 at a 194% TOB premium is an example of the opportunities presented by the existence of parent-child subsidiaries.

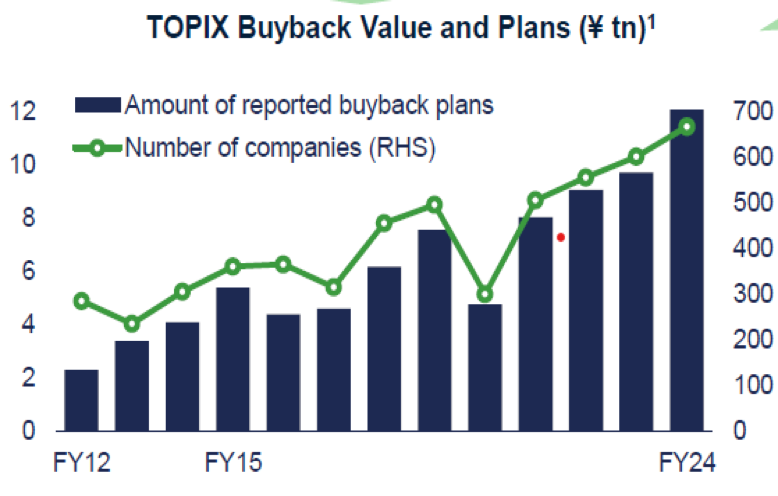

Buyback plans have reached historically high levels and continue apace. Although highly encouraging, there remains enormous scope for this pattern to continue with over 1000 listed companies holding more than 30% of their market cap in cash[1]. Undervalued (or zero-valued) real estate assets provide another rich source of hidden corporate value, for those who do enough digging. In December, TSI Holdings announced they were selling their old office building, for a staggering 30% of their market cap, and even above our independently assessed valuation.

Historically, small-caps in Japan have consistently outperformed their larger counterparts, but that pattern was disrupted two years ago when the Yen dramatically weakened by over 30%. Large-cap exporter beneficiaries were driven to heady heights by the currency tailwinds and an astonishing 27% performance gap between large and small companies resulted over two years[1]. The Bank of Japan is under increasing pressure from domestic consumers and companies to ease imported inflation resulting from the weak yen and have committed to a slow and steady normalisation of monetary policy. The question is how long a weak yen will weigh on small-caps, and what will happen when we see that pressure start to be released.

AVI has been investing in Japan for over 40 years as part of our global approach, but it was the realisation back in 2016 that we were witnessing the beginnings of a rare and remarkable shift in corporate culture that inspired us to launch a Japan-dedicated strategy. Since AVI was founded in 1985, our investment philosophy has focused on identifying undervalued, under-researched, and overcapitalized companies, and engaging intensively with management to address and correct these inefficiencies. The opportunity set available in Japan to find precisely those sorts of companies, simply does not exist anywhere else. We believe that our engagement and constructive activist approach is particularly suited to Japanese companies. The idea of self-help has percolated slowly through the market over the past ten years, and there is a growing sub-set of companies who want to improve their valuations, but are not sure how. This is again, especially pertinent in the small-mid cap space.

Our approach differentiates AVI from many of our peers, and from traditional US activist doctrine. We have found that offering solutions to the issues that keep corporate management awake at night is a far more effective opening salvo than taking a more aggressive and antagonistic stance from the offset. We come bearing management consultant-led gifts. Our investment team started their careers at the world’s top management consulting firms and investment banks. They draw on this extensive experience to thoroughly analyse companies, often producing an initial 70-80 page research report for company management that covers both the company and its peers. These bespoke reports include a comprehensive roadmap for improving operational efficiency, margins, profits, capital allocation, ESG metrics and, ultimately, valuations. We believe it is crucial to ensure that our in-depth work is not in vain and to maximize the likelihood that management will value our guidance and implement at least some of our recommendations. The alternative is to fall foul of the dreaded Japanese value trap, which is still very much a threat. As mentioned, there are nearly 4,000 listed companies in Japan, half of which trade at <1x price to book, most of which are over-capitalised, and countless which have dormant and under-valued real estate or other assets. Even now, most of these companies remain reluctant, if not outright resistant, to accepting shareholder advice or demands. Thoroughly assessing management prior to investment is a key part of our process, and our team meet with directors, non-executive directors, employees and industry experts to garner as comprehensive a picture as possible of a company “engageability”. Building strong relationships with the company and maintaining an intense pace of engagement are key pillars of our approach, with the team meeting each company on average 2-3 times a quarter and doing c.200 meetings in total a year. The Japan strategy’s idiosyncratic returns and outperformance over both the small-cap index and the net cash universe are testament to the thoroughness of our process and our efforts to avoid low-quality companies who, even with a push, will likely continue to stagnate. Instead, we seek companies with whom we can build constructive relationships and long-term value. Inevitably we will sometimes have to apply firmer pressure through shareholder resolutions or public campaigns, but always in a manner that is constructive and respectful. We do not presume to think these companies should undergo a complete cultural shift, many of which have long histories and have built market-leading expertise or products in their specific industries. Instead, we encourage and support the integration of perspectives that, though initially unfamiliar to our investee companies, will resonate with foreign investors and help them reassess Japanese companies, ultimately recognising their true value.

It was this unique blend of cultural elements that drew foreign attention to Kokusai. Often hailed as the pinnacle of Japanese art, it was, ironically, the subtle kinship foreign artists felt to their own Western traditions that fuelled The Great Wave’s popularity. Kokusai deftly incorporated aspects of Western art into his work, bridging the cultural divide and both familiarising and elevating Japanese art in the eyes of the West. This marked the beginning of a symbiotic exchange of ideas and traditions that continues to this day

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU. AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

To the extent that material on this website is issued in the UK, it is issued for the purposes of the Financial Services and Markets Act 2000

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website. The information on this website is subject to change without notice.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

This website is primarily intended for United Kingdom (“UK”) residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution, publication or use would be contrary to local law or regulation or in which AVI does not hold any necessary licence or registration. Individuals or entities in respect of whom such prohibitions apply, must not access or use the AVI website.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied.

Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility and liability for the content on third party sites.

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error. You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange. Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting your investment.

Applications to invest in AVI Global Trust referred to on this website, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents.

If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU.

AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website.The information on this website is subject to change without notice.

This website is primarily intended for UK residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution or use would be contrary to local law or regulation.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied. Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility for the content of third party sites

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error.

You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange.

Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting affecting your investment.

Applications to invest in AV Global Trust referred to on this Site, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

INVESTOR – Risk Warnings

It is very important that you read this warning and disclaimer before proceeding, as it explains certain legal and regulatory restrictions applicable to any investment services and products we provide.

The content of this website is issued by Asset Value Investors Ltd (“AVI”), 2 Cavendish Square, London W1G 0PU

AVI is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom.

This website is not directed at any person in any jurisdiction where it is illegal or unlawful to access and use such information. AVI disclaims all responsibility if you access any information in breach of any local law or regulation. All persons who access this website are required to inform themselves and to abide with all applicable local law, regulations and restrictions.

The information on this website is not directed at any person or entity in the United States, and this site is not intended for distribution or to be used by any person or entity in the United States unless those persons or entities are existing investors in funds managed by AVI and they have applicable US exemptions.

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

The funds referred to in this website are alternative investment funds (“AIFs”). The promotion of such funds and the distribution of offering materials in relation to such funds is accordingly restricted by law.

Shares in the funds mentioned in this website are not dealt in or on a recognised or designated investment exchange, nor is there a market maker in such shares, and it may therefore be difficult for an investor to dispose of his shares.

The information on this website is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by AVI.

An application for shares in any of the funds referred to on this site should only be made having fully read the relevant prospectus and most recent financial statement and semi-annual financial statements published thereafter.

The Information is provided for information purposes only and on the basis that you make your own investment decisions and do not rely upon it.

AVI is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.

Should you have any queries about the investment funds referred to on this website, you should contact your financial adviser.

Past performance is not an indication of future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested.

The funds noted in this website may be subject to higher risk and volatility than other funds and may not be suitable for all investors. These funds are not regulated.

Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

The levels and bases of and reliefs from taxation may change. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. Investors should consult their own tax adviser in order to understand any applicable tax consequences.

The information on this website, including any expression of opinion or forecast, has been obtained from, or is based on, sources believed by AVI to be reliable, but are not guaranteed as to their accuracy or completeness and should not be relied upon.

You should be aware that the Internet is not a completely reliable transmission medium. AVI does not accept any liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to any direct, indirect or consequential damage, arising out of the use of the products or services referred to herein. This does not exclude or restrict any duty or liability that AVI has to its customers under the regulatory system in the United Kingdom.

To make a complaint about this website ,please send a written complaint for the attention of the Compliance Officer at the registered address: 2 Cavendish Square, London W1G 0PU.

You agree to indemnify, defend, and hold harmless AVI, its affiliates and licensors, and the officers, partners, employees, and agents of AVI and its affiliates and licensors, from and against any and all claims, liabilities, damages, losses, or expenses, including legal fees and costs, arising out of or in any way connected with your access to or use of this website and the Information.

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party websites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party websites.

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Nothing on this site should be considered as granting any licence or right under any trademark of AVI or any third party.

Deliberate misuse of any element of this Website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the Website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations. You irrevocably waive any right to a jury trial in any dispute or proceeding arising from the use of this site.