We have reviewed Teikoku Sen-i’s Board of Directors’ opinion issued February 14 concerning our shareholder proposals.

We are disappointed that the board has rejected our moderate proposals for a share buyback and increased dividend. Our proposals were intentionally modest against the background of the company’s abnormal and value destructive overcapitalization. We had thought that, by making our proposals so modest, it would make it easier for the board to take an initial small step in the right direction.

We are also seriously concerned that the board is retaining shareholder capital without adequate quantification and financial analysis. The board’s opinion casually mentions rough figures for needed working capital and projected capital expenditures under the company’s mid-term management plan. But the published mid-term plan contains no hard numbers. The projected capital expenditures are nowhere analyzed in relation to hurdle rates or expected return on investment.

If the board of directors believes that the company needs to retain capital, as opposed to returning it to shareholders, it has an affirmative duty to explain in concrete detail how the retained capital will be invested to produce a superior rate of return on investment. The lack of detail and vague generalizations, both in the opinion and the company’s mid-term plan, reflect badly on the diligence and the board’s sense of responsibility to shareholders. Without much more detailed justification and analysis for retaining capital, the board is failing its obligations under the Corporate Governance.

In what follows we will demonstrate how modest our proposals in fact are, taking into account the company’s balance sheet, current profits and actual capital needs.

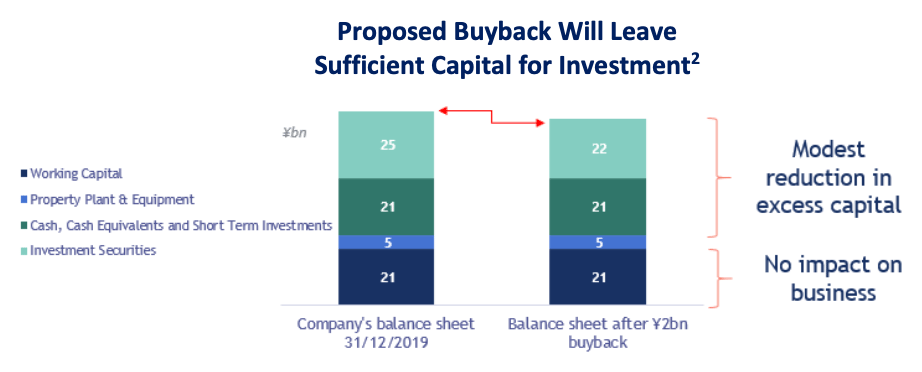

The FY2019 balance sheet shows net assets of ¥55 billion, an increase of ¥8 billion over the previous year, of which ¥38 billion consists of cash and securities net of tax, including a stake in Hulic worth ¥16 billion1.

Our proposed share buyback of ¥2 billion, amounting to 3% of outstanding shares, can be funded by selling just 10% of the company’s interest in Hulic.

In our view the board cannot justify having one company, Hulic, with which there is no meaningful business synergy or relationship, constitute 32% of total assets. If the board were properly sensitive to the objectives of capital efficiency and corporate value, it would promptly divest the entire stake in Hulic and return the proceeds to shareholders. Nonetheless, in order to induce the board to take a small initial step in the right direction, we proposed a much smaller disposition of the Hulic stake.

With the rejection of our proposal the board has openly declared that it has no intention of addressing the company’s massive and unproductive overcapitalization in general or reducing its outsized stake in Hulic. It has ignored Principle 1.4 of the Corporate Governance Code, and the absence of cost of capital in Teikoku’s arguments and focus on vague business ties with Hulic, shows a worrying lack of consideration towards shareholders and returns on equity.

Our other modest proposal was to pay a dividend of ¥76 per share, or roughly ¥2 billion in aggregate, as against ¥4.3 billion in net profit for FY2019—a payout ratio of approximately 50%.

In rejecting our proposed dividend, the board’s opinion once again refers to vague and unspecified capital expenditure plans and needs.

We have stressed repeatedly that we support meaningful and necessary capital expenditures. However, Teikoku Sen-i’s overcapitalization is extreme and obvious. Cash earning no return and low yielding securities have continued to accumulate and grow, destroying potential corporate value.

We believe that the board’s opinion rejecting our proposals without adequate quantitative justification in terms of capital efficiency and return on investment bespeak a larger failure of corporate governance and dereliction of duty.

The “group shareholders” of the company that have sided with and protected management at the expense of general shareholders over the years must acknowledge their share of responsibility for this failure of corporate governance.

Anyone who objectively analyses the company’s balance sheet in relation to its actual business and capital needs will immediately recognize that something is wrong and abnormal.

***

In the coming weeks leading to the annual shareholders meeting in March, we will be communicating with our fellow shareholders, including “group shareholders”, to encourage them to support our proposals and send a message about their dissatisfaction with the company’s corporate governance and basic direction under current management.

Underneath Teikoku’s inefficient balance sheet hides an excellent business that deserves to trade at a significantly higher share price. Through our modest proposals we hope to improve Teikoku’s long-term capital efficiency for the benefit of all shareholders.

1 After capital gains tax of 31%, assuming zero-cost base

2 Assuming 31% capital gains tax, funded by the sale of ¥3bn Hulic shares, such that the net proceeds are ¥2bn

This website, and the information contained herein, (collectively referred to as “the Website”) is being provided for the shareholders of Teikoku Sen-i Co., Ltd. (“Teikoku”) for information purposes only. Asset Value Investors Limited (“AVI”) is the investment manager of two of the shareholders of Teikoku, namely AVI Global Opportunities Trust (“AGT”) and AVI Japan Opportunities Trust (“AJOT”).

AVI is authorised and regulated by the UK Financial Conduct Authority (“FCA”) and is also registered as an Investment Advisor with the United States Securities and Exchange Commission (the “SEC”) under the United States Investment Advisors Act of 1940.

The Website is directed only at Professional Clients or Eligible Counterparties as defined by the UK FCA.

AVI sent written proposals addressed to Teikoku (the “Proposals”) through which AVI seeks to ask shareholders to vote on an increased dividend and the introduction of a buyback programme. The Proposals are accessible through the Website. AVI created the Website to help enable visitors to reach their own conclusion regarding whether or not to support the Proposals.

The Website was created solely for the purpose mentioned above and is provided for information purposes only. AVI is by no means soliciting or requesting other shareholders of Teikoku to jointly exercise their shareholders’ rights with AVI (including, but not limited to, voting rights).

AVI declares that it does not intend to be treated or deemed a “joint holder” (kyo-do hoyu-sha) with other Teikoku shareholders under the Japanese Financial Instruments and Exchange Act by virtue of disseminating information through the Website or engaging in dialogue with other Teikoku shareholders in or through this Website.

The Website exclusively represents the opinions, interpretations and estimates of AVI in relation to Teikoku’s business and governance structure. AVI is expressing such opinions, interpretations and estimates solely in its capacity as an investment manager of AGT and AJOT.

The information contained herein is derived from proprietary and non-proprietary sources deemed by AVI to be reliable. While AVI believes that reasonable efforts have been made to ensure the accuracy of the information contained in the Website, AVI makes no representation or warranty, expressed or implied, as to the accuracy, completeness or reliability of such information.

本ウェブサイトならびにここに含まれるすべての情報(以下、総称して「本ウェブサイト」といいます)は、帝国繊維株式会社(以下、「帝繊」)の株主のために情報を提供するという唯一の目的で開設しております。アセットバリューインベスターズ(以下、「AVI」)は、帝繊の株主であるAVIグローバル・オポチュニティー・トラスト(「AGT」)ならびにAVIジャパン・オポチュニティ・トラスト(「AJOT」)の資産運用管理者です。

AVIは英国の金融行為監督機構(「FCA」)の認可および規制を受けており、また米国1940年投資顧問法に基づき投資顧問として米国証券取引委員会(「SEC」)に登録しております。

本ウェブサイトは、英国FCAが定めるプロ顧客ならびに適格取引先のみを対象としています。

AVIは帝繊に対して、配当増加と自己株主取得方針の導入を行うことについて株主総会決議を求める提案書(以下「本提案」)を送付しました。本提案は本ウェブサイトより入手できます。AVIは本ウェブサイトを閲覧される皆さまが本提案を支持するか否かについて、ご自身で判断される際にお役に立てればと考え、本ウェブサイトを開設しました。

本ウェブサイトは、上記の目的のためだけに開設されたものであり、情報の提供のみを目的として掲載しております。AVIは、帝繊の他の株主の皆さまに対してAVIと共同で株主権(議決権を含みますがそれに限りません)を行使していただきたいと依頼、または要請しているわけではありません。

AVIは、本ウェブサイトを通じての情報提供又は本ウェブサイトを通じて他の帝繊株主と対話を行うことにより、他の株主と金融商品取引法の上の「共同保有者」として扱われ、またはみなされることを意図しておりません。

本ウェブサイトは、帝繊の事業およびガバナンス体制に関するAVIの見解、解釈 、評価を掲載したものであり、AVIはあくまでAGTおよびAJOTの資産運用管理者の立場からこれらの見解、解釈 、評価を述べております。

本ウェブサイトに掲載される情報は、AVIが信頼できると判断した専有又は非専有の情報源から得たものです。AVIは本ウェブサイトに掲載する情報の正確性を確保するために合理的な注意を払っておりますが、その正確性、完全性および 信頼性について明示・黙示にかかわらず一切の表明・保証をするものではありません。