Teikoku is a high-quality business, providing essential disaster prevention equipment through an impressive distribution network. It is the market leader and experienced manufacturer of fire hoses in Japan, commanding a 45% market share. Building on this strong base, Teikoku has developed a diverse product mix of disaster prevention equipment. Its low CAPEX requirements and high margins underpin a business that, with a more efficient balance sheet, could generate a ROE in excess of 20%.

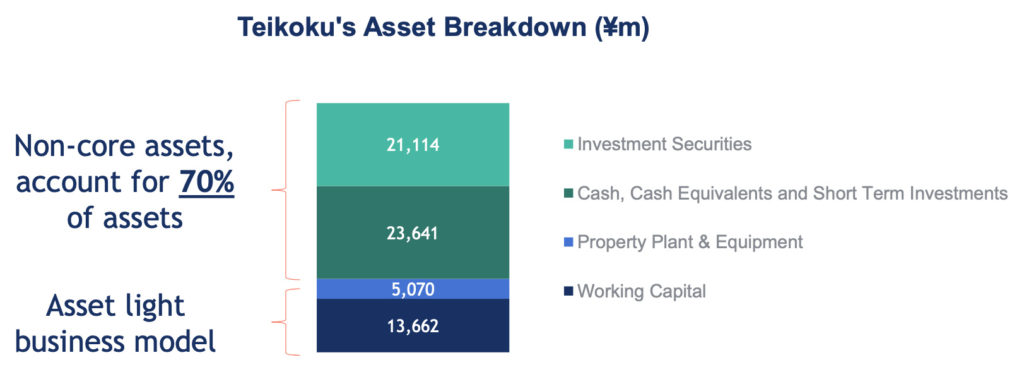

However, Teikoku’s quality business is hidden under a mountain of non-core assets. 70% of balance sheet assets are allocated to low returning net cash and investment securities. These have a return on equity to Teikoku of less than 1%.

Teikoku has given no quantitative justification for its ¥23bn investment in Hulic. It has blindly allowed its stake in Hulic to grow in value such that it now accounts for over 30% of total assets. Principle 1.4 of the Corporate Governance Code states that “when companies hold shares of other listed companies as cross-shareholdings, they should disclose their policy with respect to doing so, including their policies regarding the reduction of cross-shareholdings” (emphasis added)

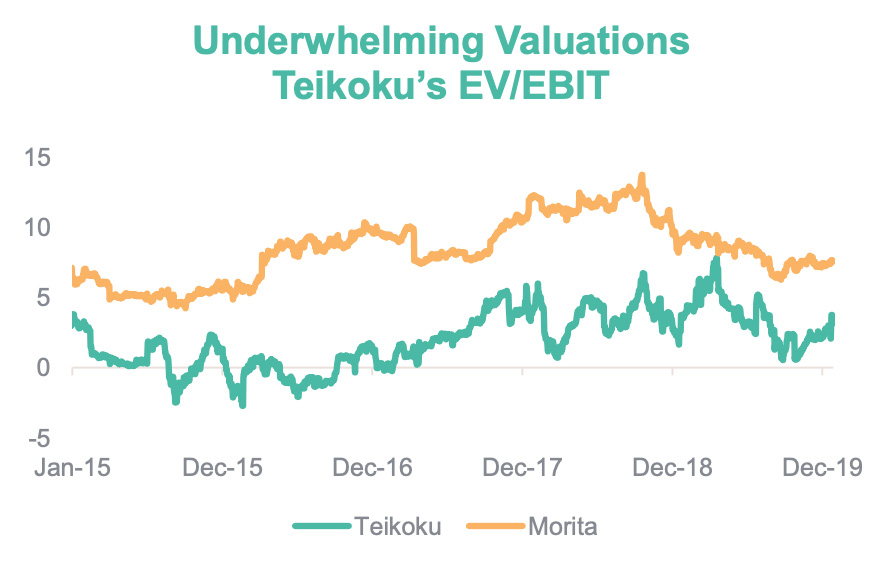

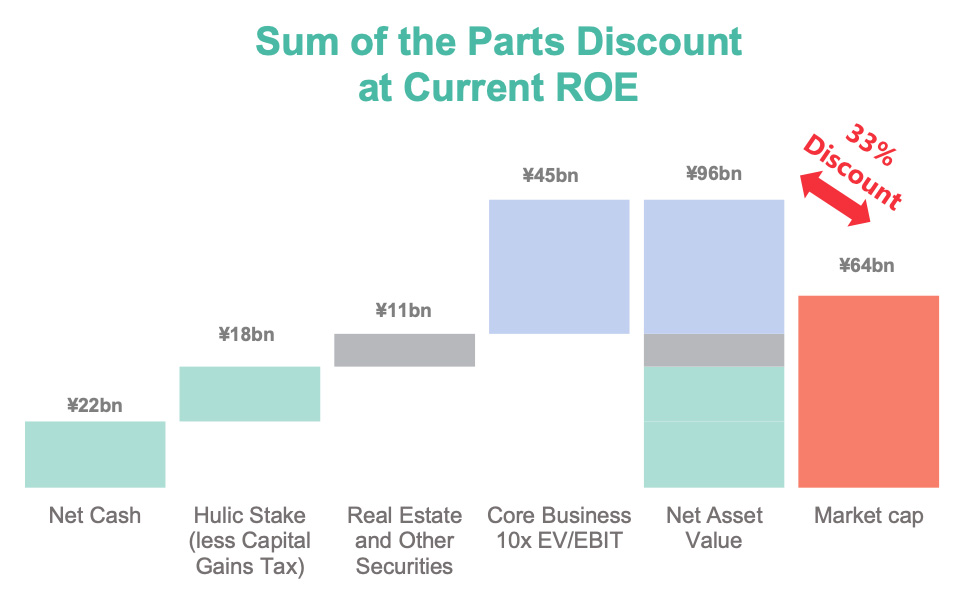

Non-core assets trapped in Teikoku are valued by the market at a discount to their real value. Teikoku’s 2.6% in Hulic accounts for 25% of Teikoku’s market cap (after capital gains tax), and cash accounts for 34% of Teikoku’s market cap, resulting in a very low implied valuation for Teikoku’s high-quality business. Inefficient structure depresses Teikoku’s valuation and creates a “sum of the parts discounts”

This website, and the information contained herein, (collectively referred to as “the Website”) is being provided for the shareholders of Teikoku Sen-i Co., Ltd. (“Teikoku”) for information purposes only. Asset Value Investors Limited (“AVI”) is the investment manager of two of the shareholders of Teikoku, namely AVI Global Opportunities Trust (“AGT”) and AVI Japan Opportunities Trust (“AJOT”).

AVI is authorised and regulated by the UK Financial Conduct Authority (“FCA”) and is also registered as an Investment Advisor with the United States Securities and Exchange Commission (the “SEC”) under the United States Investment Advisors Act of 1940.

The Website is directed only at Professional Clients or Eligible Counterparties as defined by the UK FCA.

AVI sent written proposals addressed to Teikoku (the “Proposals”) through which AVI seeks to ask shareholders to vote on an increased dividend and the introduction of a buyback programme. The Proposals are accessible through the Website. AVI created the Website to help enable visitors to reach their own conclusion regarding whether or not to support the Proposals.

The Website was created solely for the purpose mentioned above and is provided for information purposes only. AVI is by no means soliciting or requesting other shareholders of Teikoku to jointly exercise their shareholders’ rights with AVI (including, but not limited to, voting rights).

AVI declares that it does not intend to be treated or deemed a “joint holder” (kyo-do hoyu-sha) with other Teikoku shareholders under the Japanese Financial Instruments and Exchange Act by virtue of disseminating information through the Website or engaging in dialogue with other Teikoku shareholders in or through this Website.

The Website exclusively represents the opinions, interpretations and estimates of AVI in relation to Teikoku’s business and governance structure. AVI is expressing such opinions, interpretations and estimates solely in its capacity as an investment manager of AGT and AJOT.

The information contained herein is derived from proprietary and non-proprietary sources deemed by AVI to be reliable. While AVI believes that reasonable efforts have been made to ensure the accuracy of the information contained in the Website, AVI makes no representation or warranty, expressed or implied, as to the accuracy, completeness or reliability of such information.

本ウェブサイトならびにここに含まれるすべての情報(以下、総称して「本ウェブサイト」といいます)は、帝国繊維株式会社(以下、「帝繊」)の株主のために情報を提供するという唯一の目的で開設しております。アセットバリューインベスターズ(以下、「AVI」)は、帝繊の株主であるAVIグローバル・オポチュニティー・トラスト(「AGT」)ならびにAVIジャパン・オポチュニティ・トラスト(「AJOT」)の資産運用管理者です。

AVIは英国の金融行為監督機構(「FCA」)の認可および規制を受けており、また米国1940年投資顧問法に基づき投資顧問として米国証券取引委員会(「SEC」)に登録しております。

本ウェブサイトは、英国FCAが定めるプロ顧客ならびに適格取引先のみを対象としています。

AVIは帝繊に対して、配当増加と自己株主取得方針の導入を行うことについて株主総会決議を求める提案書(以下「本提案」)を送付しました。本提案は本ウェブサイトより入手できます。AVIは本ウェブサイトを閲覧される皆さまが本提案を支持するか否かについて、ご自身で判断される際にお役に立てればと考え、本ウェブサイトを開設しました。

本ウェブサイトは、上記の目的のためだけに開設されたものであり、情報の提供のみを目的として掲載しております。AVIは、帝繊の他の株主の皆さまに対してAVIと共同で株主権(議決権を含みますがそれに限りません)を行使していただきたいと依頼、または要請しているわけではありません。

AVIは、本ウェブサイトを通じての情報提供又は本ウェブサイトを通じて他の帝繊株主と対話を行うことにより、他の株主と金融商品取引法の上の「共同保有者」として扱われ、またはみなされることを意図しておりません。

本ウェブサイトは、帝繊の事業およびガバナンス体制に関するAVIの見解、解釈 、評価を掲載したものであり、AVIはあくまでAGTおよびAJOTの資産運用管理者の立場からこれらの見解、解釈 、評価を述べております。

本ウェブサイトに掲載される情報は、AVIが信頼できると判断した専有又は非専有の情報源から得たものです。AVIは本ウェブサイトに掲載する情報の正確性を確保するために合理的な注意を払っておりますが、その正確性、完全性および 信頼性について明示・黙示にかかわらず一切の表明・保証をするものではありません。