* As at 31 January 2026

** Source: Morningstar, performance period 30 June 1985 to 31 January 2026, TR net of fees, GBP

*** As at 31 October 2025, includes: management fee 0.70%, marketing and administration costs

If you’re not familiar with us, here’s a video that’ll help. This video is presented by Joe Bauernfreund, CEO and Chief Investment Officer at Asset Value Investors.

AVI Global Trust (“AGT”) provides expertly managed exposure to the opportunities presented in various parts of the world. The investment strategy identifies valuation anomalies to create a concentrated, unique and diversified portfolio of stocks. The investment manager then engages with these companies to improve shareholder value.

| Label | 2025 % | 2024 % |

|---|---|---|

| < £1 billion | 34 | 37 |

| > £1 billion - < £5 billion | 30 | 20 |

| > £5 billion - < £10 billion | 15 | 10 |

| > £10 billion | 21 | 33 |

| Label | 2025 % | 2024 % |

|---|---|---|

| Holding Companies | 48 | 43 |

| Closed-ended funds | 31 | 31 |

| Asset-backed Special Situations | 21 | 26 |

| 31/01/2026 | % of NAV |

|---|---|

| Toyota Industries | 8.3% |

| D'Ieteren | 7.9% |

| Chrysalis Investments | 7.1% |

| News Corp - USD 'A' | 6.3% |

| Vivendi | 6.0% |

| Harbourvest Global PE | 5.9% |

| Samsung C&T | 5.7% |

| Jardine Matheson | 5.4% |

| Mitsubishi Logistics | 5.1% |

| Cordiant Digital Infrastructure | 4.9% |

| Total | 62.6% |

The AVI Global Trust plc (“AGT”) was established in 1889 in order to generate profits for its shareholders by investing in the shares of other companies. In 1985, Asset Value Investors (“AVI”) were appointed as investment managers of AGT, which at that point held a total of £6 million in assets under management. As at 31 January 2026, total assets under management of AGT stand at over £1.3 billion.

Asset Value Investors (“AVI”) value investment process for AVI Global emphasizes bottom up fundamental research, using both quantitative and qualitative techniques.

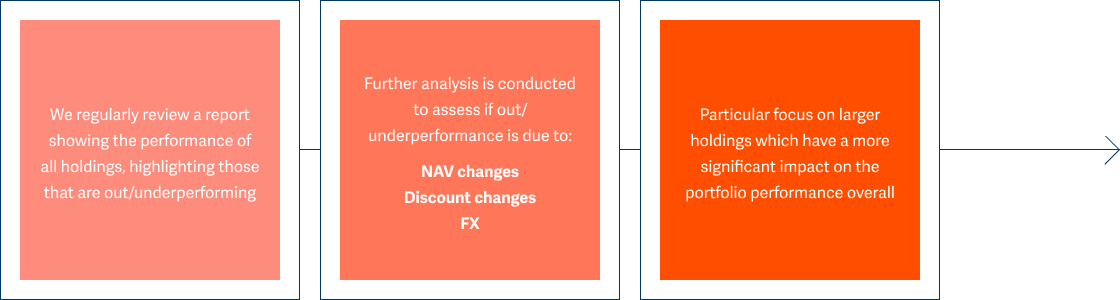

AVI’s screening process starts by looking at an investment universe which consists of global holding companies, closed-end funds and asset backed companies. We have detailed models on approximately 415 companies out of this universe, which track stock prices and earnings information.

Throughout the filtering process AVI asks the following questions:

AVI’s analysts track stock prices, earnings and balance sheet information with an aim to identify good quality companies trading on a discount to their NAV which exhibit clear trends to create long-term value.

Research includes:

We want to have a reasonably concentrated portfolio (typically 30-40 stocks) of our best ideas

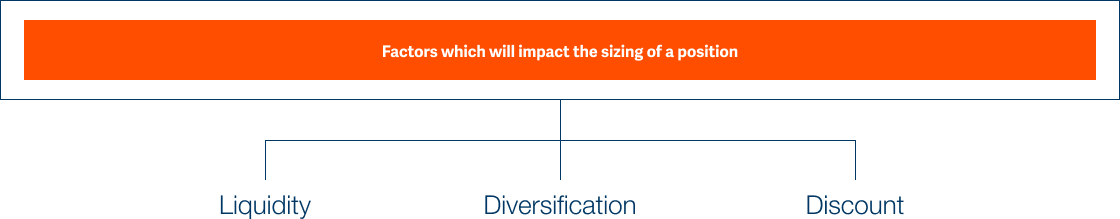

The objective of AVI’s portfolio construction process is to end up with a concentrated portfolio of about 40-50 holdings, facilitating a clear monitoring process of the entire portfolio. AVI picks stocks that meet our investment criteria and once we decide to invest we seek a minimum position size of approximately 2% of the portfolio, however the timing of the catalyst and the liquidity of the stock can result in the holding being greater or lesser than 2%.

The investment philosophy employed by Asset Value Investors (“AVI”), the managers of AVI Global, strives to identify valuation anomalies and focuses on investing where the market price does not reflect the estimated intrinsic value.

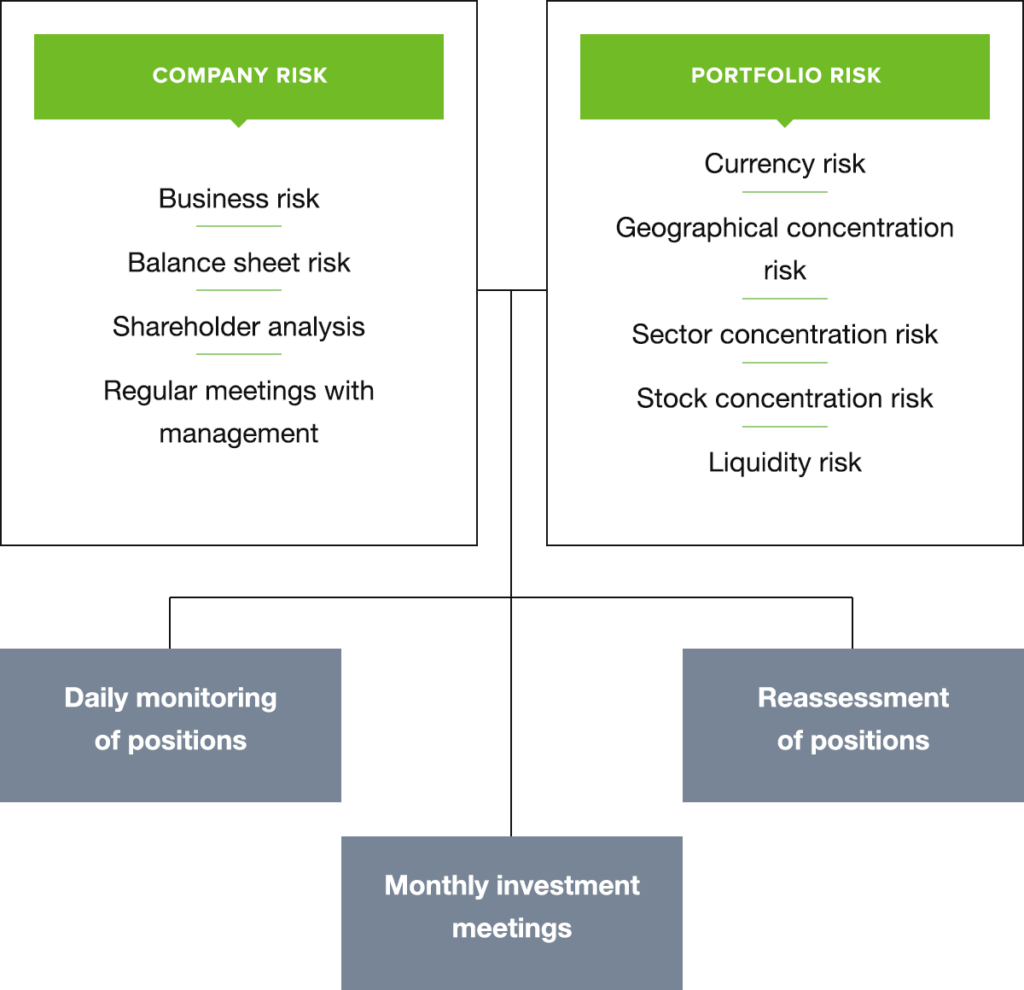

Asset Value Investors (“AVI”) deep value investment process strives to identify and mitigate downside risks in all market environments.

We seek to construct a discounted portfolio of stocks consisting of companies which due to the geographic and sector diversification of their underlying assets are less likely to display high correlations to the market.

AVI’s risk management techniques include thorough qualitative fundamental bottom up research to establish a company’s real value. We monitor our holdings on an on-going basis and our in-house OMS system contains an automatic alert system which alerts us of any breaches of built-in risk parameters.

The investment management team holds regular meetings discussing the portfolio with a view to reassess, sell or buy securities and to discuss current cash position as well as sector and geographic weighting.

Exclusionary screening is not our guiding framework, however there are certain exceptions to this. AVI will not invest in a company with direct involvement* in:

Or companies that engage in child labour or human exploitation as defined by the relevant ILO conventions.

* whereby more than 5% of that company’s NAV is derived from these activities.

As part of our in-depth research into companies, we consider and discuss material ESG risks and opportunities, including climate-related risks and opportunities. Supported by ISS Norms-based research, we also assess any involvement in actual or potential violations of international norms and standards.

We have developed a bespoke ESG monitoring system built into our proprietary database to ensure ESG factors are considered alongside financial analysis. We conduct ongoing ESG assessments of portfolio companies’ performance against defined ESG metrics. A scoring system is used to assess trends and highlight potential areas for engagement.

Based on our assessments, we send tailored questionnaires to all portfolio companies to request additional ESG information and promote improved sustainability disclosure. This can provide a useful starting point for deeper engagement on ESG issues.

Controversies can bring major reputational damage and a loss of consumer trust which can have a significant effect on a company’s value. We promote responsible conduct by actively engaging and encouraging our companies to strengthen their focus on ESG issues.

We seek to build constructive relationships with the boards and management of our portfolio companies, offering detailed suggestions to sustainably increase corporate value by building resilience to ESG risks and promoting responsible business practices.

At AGT, we believe that integrating ESG and sustainability factors into our investment process, alongside traditional financial factors, is important to enable us to deliver strong and durable performance to our clients and to meet our broader investment responsibilities. ESG matters, including climate change, are part of our analysis and risk assessment when deciding whether an investment should be made. Climate change poses both risks and opportunities. The transition to a low-carbon economy will affect all businesses, irrespective of their size, sector, or geographic location. Therefore, no company’s revenues are immune, and the assessment of such risks must be considered within any effective investment approach.

As active investors, once we have invested in a company, we take our stewardship responsibilities seriously. AGT acknowledges that it can have an indirect impact on communities and the environment through the companies it holds in its portfolio. We look to engage with boards and management on an ongoing basis and create an active dialogue on various ESG factors. Often, engagement with investee boards is undertaken with a view to helping realise value or to address potential issues with governance. We seek to ensure good governance practices are being upheld and encourage adherence to responsible and ethical conduct. AGT also views voting at company meetings to be an important lever in our stewardship responsibilities and will vote at company meetings when we have the opportunity to do so.

See the sections below for further insights into the ESG work at AGT.

AVI has developed a proprietary ESG monitoring system that allows us to track the extent to which our portfolio companies are effectively managing ESG issues and their progress against defined ESG metrics. This process helps to highlight trends and identify weaknesses where we can engage constructively with companies to build resilience to ESG risks and promote responsible business practices.

AVI became a signatory to the UN-supported Principles for Responsible Investment (PRI) on 09 April 2021.

We are aligned with the PRI’s belief that an economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.

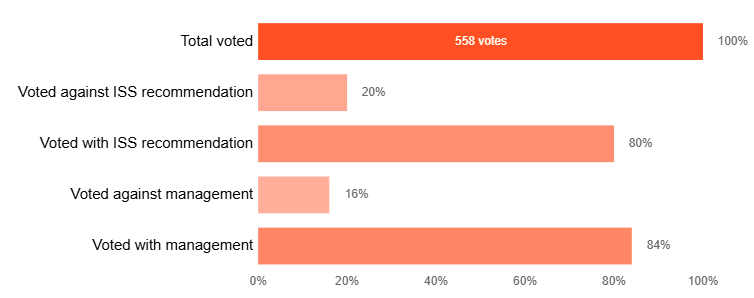

We consider proxy voting to be an important lever in engaging with our portfolio companies and ensuring that our perspectives on environmental, social and governance issues are represented.

As responsible, active stewards of our clients’ capital, we have a duty to vote carefully and thoughtfully on their behalf, and we take this duty seriously. We aim to vote at every general meeting for which we are eligible.

AVI Global Trust plc (“AVI Global”) is a closed-end investment trust with shares listed on the London Stock Exchange and part of the FTSE 250 index. Shares in AVI Global can be bought directly on the London Stock Exchange or through the following platforms:

There are two ways that the value of a share in an investment trust is often expressed:

It’s the role of the asset management company, AVI ,appointed by AVI Global to plan, manage the assets and oversee the investments on behalf of investment trust.

Unconstrained

AGT’s index agnostic approach allows for investments to be made in areas of the market that are often overlooked by other funds, typically due to their unconventional structures, size, or liquidity. These areas can include listed family holding companies and private equity, which over time, have been shown to deliver excess returns.

AGT’s unique approach of investing in holding companies, closed-ended funds and asset-backed special situations differentiates us from other funds, with portfolio holdings unlikely to be found elsewhere. Through these unconventional structures, AGT gains exposure to multiple underlying companies, providing both sector and geographic diversification benefits.

Track Record of Outperformance

Through an unconstrained and unique investment philosophy, AGT has been able to outperform its comparator benchmark over the long run. Since 1985, AGT’s average annual performance has been 11.5% vs 9.0% for the benchmark

(View chart below) Over the past ten years, the ordinary dividends paid by AGT to shareholders have grown by more than 6.5 times. The level of income may vary due to the occasional receipt of large, one-off, special dividends from investee companies and it is for this reason that AGT has paid special dividends in the past few years. Naturally, there can be no guarantee that further special dividends will be paid in the future.

* as at 30 September 2022.

They are quoted companies listed on the London Stock Exchange with Boards of Directors; they are subject to the listing rules of the UK Listing Authority established under the Financial Services and Markets Act. ‘Investment Trusts’ are also subject to the Companies Act 1985, as amended. The conduct of investment managers in promoting packaged products (‘ISA’, Share Plans) with underlying investment trust investments are regulated by the FCA.

Investment trusts can borrow money and invest the proceeds. This will magnify returns to investors in a rising market (and vice versa in falling markets). This is known as financial gearing. Typically the ‘gearing’ is described as a ratio (of borrowing to assets) – a gearing factor of 120 means that on a trust with equity of £100 million it has £20 million of debt (bank borrowings).

Typically anything from 50 to 100 shares. The ‘Fund Manager’ must have regard to the objective of the trust. To that end the underlying stocks are bought or sold to deliver either capital growth or income. Within those portfolios the managers will assess the stocks on a regular basis to ensure that they will deliver the objective, hopefully selling in advance of profit warnings or any other adverse market change that could impact on either the ability to deliver income or capital appreciation. Sometimes that can’t be achieved; that’s why ‘investment trusts’ have a spread of investments.

The spread is set by the marketmakers. There is no standard spread, it depends on the ‘liquidity’ of a particular stock, but in the case of AVI Global the average spread is 0.22% *. It does not include stamp duty which is a tax at 0.5% of the value of all share purchases.

* as at 28th February 2015

The dividend yield is the last 12 months dividends (historic) divided by the share price.

All are calculated with reference to the previous closing mid price.

The company secretary has the responsibility for co-ordinating all aspects of the investment trust to ensure that it complies with its legal and financial reporting including any circulars etc., report and accounts, interim reports; convening board meetings, minutes and follow up there from, as well as liaison with the Board and external advisers.

The Board is responsible to shareholders; it oversees the external relationships, principally the fund management relationship, to ensure that the trust’s objective is met.

Under the Companies Act all public companies must maintain a register of their shareholders to record title to the security; to determine entitlement to dividends or capital distributions.

This website is directed only at Professional Clients and Self-Certified Sophisticated Investors as defined by the UK Financial Conduct Authority (“FCA”).

The contents of this website are communicated by Asset Value Investors Limited (“AVI”) in respect of AVI Global Trust plc ( the “Company”). AVI is authorised and regulated by the FCA, with registered number 01881101 and which has its registered office at 2 Cavendish Square, London W1G 0PU, United Kingdom.

Nothing in this website is to be taken as a financial promotion and all contents are provided for information purposes only. Further, nothing in this website is to be taken as investment or tax advice. If you are unclear about any of the information on this website or its suitability for you, you must contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The price of the Shares will be determined by supply and demand in the market as well as NAV per Share. The market price of the Shares is therefore likely to fluctuate and may represent either a premium or discount to NAV per Share.

General risk warning: All investment is subject to risk. The value of the Shares may go down as well as go up. Past performance is no guarantee of future returns and there is no guarantee that the market price of the Shares will fully reflect their underlying net asset value. There is also no guarantee that the Company’s investment objective will be achieved.

The information contained in this website may contain forward-looking statements. Any statement other than a statement of historical fact is a forward-looking statement. Actual results may differ materially from those expressed or implied by any forward-looking statement. You should not place undue reliance on any forward-looking statement.

Neither the Company nor AVI undertakes any obligation to update or revise any information in this website, including without limitation, any forward-looking statements, whether as a result of new information, future events or otherwise, and neither the Company nor AVI will confirm the accuracy or completeness of any information at any given time.

This website may contain links to third party websites. These links are provided for your information and convenience only, and do not amount to a recommendation or endorsement by the Company or AVI of that third party or its website. Neither the Company nor AVI has any control over the content of any third party website and neither the Company nor AVI has verified the accuracy of any content on any third party website. Accordingly, neither the Company nor AVI is liable for the content or availability (or lack of availability) of such third party websites.

This website is provided for your use “as is” without any warranties (whether express or implied) of any kind including, but not limited to, the warranty of non-infringement of third party rights or freedom from computer virus. As a result, neither the Company nor AVI accepts any ongoing obligation or responsibility in respect of any errors, omissions, interruptions or delays in service which may occur. Internet is not a secure medium of communication unless the data being sent is encrypted. Neither the Company nor AVI accepts any responsibility for unauthorised access by a third party or the corruption of data sent to it.

By continuing to use this website, you agree to the exclusion by the Company and AVI, to the extent permitted by applicable law and regulation, of any and all liability for any direct, indirect, punitive, consequential, incidental, special or other damages, or any loss of profits, revenue or data arising out of or relating to your use of and our provision of this website and its content. The Company may change these terms and conditions from time to time and any such changes will be posted on this website. Your access to this website is governed by the version of these terms and conditions then in force.

THIS WEBSITE IS NOT INTENDED TO OFFER OR TO PROMOTE THE OFFER OR SALE OF THE SHARES (THE “SHARES”) OF AVI JAPAN OPPORTUNITY TRUST PLC (THE “COMPANY”) IN THE UNITED STATES OR TO ANY “U.S. PERSONS” AS DEFINED IN REGULATION S (“US PERSONS”) UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”).

THE MATERIALS CONTAINED HEREIN ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, AND MUST NOT BE MADE AVAILABLE, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN THE UNITED STATES OR IN ANY OTHER JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE LAW OR REGULATION.

The Company has not been and will not be registered under the US Investment Company Act of 1940, as amended (the “Investment Company Act“), and as such holders of the Shares are not and will not be entitled to the benefits of the Investment Company Act. The Shares have not been and will not be registered under the Securities Act, or with any securities regulatory authority of any state or other jurisdiction of the United States, and may not be offered, sold, resold, pledged, delivered, assigned or otherwise transferred, directly or indirectly, into or within the United States or to, or for the account or benefit of, any US Persons. There has not been and there will not be a public offer of the Shares in the United States. Potential users of the information contained in this website are requested to inform themselves about and to observe all applicable restrictions.

The information contained in this website does not constitute or form a part of any offer to sell or issue, or the solicitation of any offer to purchase, subscribe for or otherwise acquire, any securities in the United States or in any jurisdiction in which, or to any person to whom, such an offer or solicitation would be unlawful.

By clicking “Agree” below, you represent, warrant, undertake and agree that (1) you have read, understood and agree to be bound by the terms and conditions and other information set out herein, (2) you are permitted under applicable laws and regulations to receive the information contained in this website, (3) you are located outside the United States and are not a US Person, and (4) you will not transmit or otherwise send any information contained in this website to any persons in the United States or who are US Persons or to any publications with a general circulation in the United States. If you cannot so represent, warrant, undertake and agree, you must click the button labelled “Decline” or otherwise exit this website.

AVI Global Trust’s (AGT) NAV rose +2.6% in January 2026.

D’Ieteren was the standout performer adding +153bps to NAV and we write about this below.

Other strong contributors included Samsung C&T (+80bps), Hyosung Corp (+51bps) and HD Hyundai (+44bps) – with share price returns of +26%, +33% and +24%, respectively.

At the other end, Chrysalis was a meaningful (-95bps) detractor, as the shares fell -6% on the last day of the month, following the publication of a disappointing NAV which revealed a further write-down at wefox (7% of NAV). We wrote last month about the proposed orderly realisation. With the shares trading at a 33% discount (36% ex-listed and cash), we see attractive returns from this discount unwinding.

AVI Global Trust’s (AGT) NAV rose +0.4% in December 2025.

Chrysalis Investments was the largest contributor, adding +43bps to returns. This was followed by Cordiant Digital Infrastructure and Youngone Holdings, contributing +23bps and 17bps, respectively.

On the other side of the ledger, Vivendi detracted -42bps with Hyosung Corporation and Frasers Group also detracting from returns.

AVI Global Trust’s (AGT) NAV declined -0.6% in November 2025.

Jardine Matheson was the top contributor adding +40bps to returns. Other strong contributors were Tokyo Gas and Youngone Corp (both +31bps) . We expand upon Youngone Corp – and its parent Youngone Holdings – below.

Vivendi was the standout detractor shaving off -154bps. Chrysalis, D’Ieteren and News Corp also detracted.

AVI Global Trust’s (AGT) NAV declined -0.7% in October 2025.

Samsung C&T (+43bps), HD Hyundai (+41bps) and Hyosung Corp (+41bps) were the most significant contributors, and we discuss Korea below.

Elsewhere, Vivendi also contributed (+37bps) and Christian Dior added (+36bps) during a month in which LVMH published a Q3 sales update – the shares have now risen more than 30% since we added to the position, as detailed in the June 2025 newsletter.

The main detractors were Gerresheimer (-85bps), News Corp (-82bps) and Mitsubishi Logistics (-32bps). An update on News Corp follows later.

AVI Global Trust’s (AGT) NAV was flat in September.

In a month of modest pickings, News Corp, Aker and Chrysalis were the top contributors adding a little more than 30bps each. Both D’Ieteren and Gerresheimer detracted meaningfully, shaving off -98bps and -83bps respectively.

September marks the end of AGT’s financial year. AGT delivered respectable absolute performance, with a NAV total return of +12.4%. In relative terms, this left the annual performance -4.4% behind the MSCI AC World Index (our Comparator Benchmark) which returned +16.8%.