If you were told that one of the most dynamic, environmentally friendly companies in Europe was controlled by a man described by The Times last year as an “oil tycoon”, what would you say?

Well, that is just the case. The company is Aker Horizons, and the tycoon is Kjell Røkke.

Asset Value Investors (“AVI”) has invested in family-controlled businesses for over 35 years. We have long contended that the influence of the right kind of controlling shareholder is a benefit – not a burden as is often suggested. In this vein we seek to align capital with exceptional families who act as active stewards of capital, creating wealth for themselves and minority shareholders. As a result, we have spent a lot of time over the years thinking about the G for governance in ESG.

What we are witnessing in 2021 is that families – famed for their long-term time horizons – are reacting to arguably the world’s greatest challenge: climate change. As such, we view family businesses as natural supporters of environmental issues. We see this across our portfolio; from EXOR, the holding company of the Agnelli family who are pushing electrification at Stellantis and Ferrari, to the Wallenberg’s Investor AB who talk of “future-proofing” their portfolio.

It is however Kjell Røkke’s Aker that has been most active. So, what have they done and how does it provide an insight into how to think about ESG?

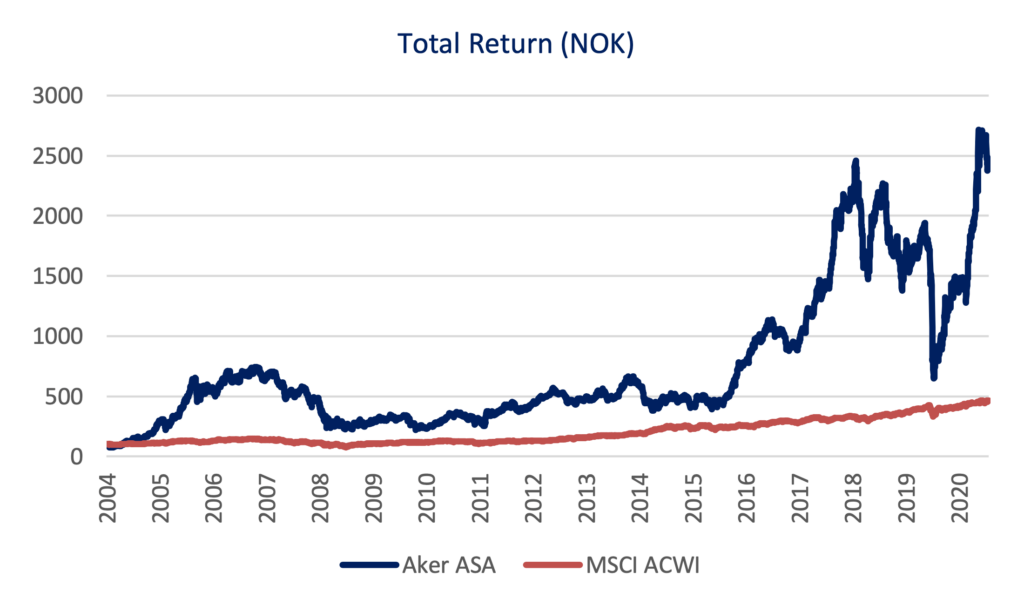

In 1996 Kjell Røkke became the largest shareholder in Aker – an industrial group dating back to the 1840s. Aker re-listed in 2004 and has subsequently achieved annualised shareholder total returns of +21%. These strong returns have been built on active portfolio management and deal making, principally in oil and gas and related sectors. In the early years, Aker’s performance was built on the boom in oilfield services, followed more recently by growth in oil exploration and production (“E&P”). This culminated in the creation of Aker BP – the product of a merger between Det Norske and BP subsidiary BP Norge – in 2016.

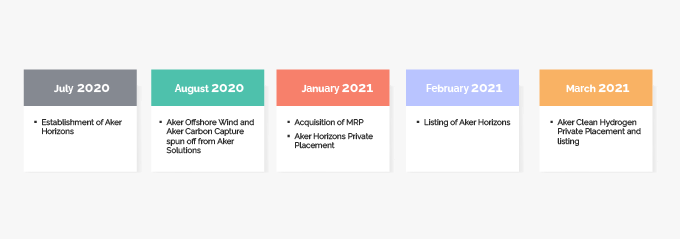

In 2020 Aker announced the creation of Aker Horizons – a “holding company dedicated to developing and operating companies within renewable energy and low-carbon segments”. Initially Aker Horizons’ portfolio consisted of stakes in two assets spun-off from Aker Solutions: Aker Off- shore Wind and Aker Carbon Capture. In 2021 these have been complimented by the acquisition of a 75% stake in Mainstream Renewable Power (“MRP”), a company active in wind and solar energy internationally. The investment in MRP, inclusive of new equity, totalled €758m and was funded through a private placement, as well as the issuance of a convertible bond. Aker took part in both, and made a further loan to Aker Horizons, highlighting how holding companies can support their operating asset’s capital market activities. Subsequently, Aker Horizons has launched and listed Aker Clean Hydrogen, a company operating in the industrial clean hydrogen market.

Taken together, Aker have created a diversified collection of renewable energy and technology companies. Collectively, Aker Horizons’ companies are active across the whole value chain – from energy production, to transmission, and even the capture and storage of emissions. As is indicative of how family run businesses manage risk, the diversified nature of Aker Horizons’ operations means that success is not wedded to one future energy market outcome.

Aker sees this strategic development not as a step-change as some have depicted it, but rather as an extension of a trend that forms an integral part of Aker’s history. This evolution should be seen within the context of Aker having continually adapted and moved with the times, from a manual workshop to shipbuilding; from offshore construction to oilfield services; and now from oil and gas to renewables. At each stage in Aker’s history, the knowledge, skills and capital of the prior step inform the next.

For example, expertise in deep water offshore wind is built on 40 years’ experience in designing, delivering, and servicing semi-submersible drilling and production platforms in the oil and gas industry. Likewise, Aker’s proprietary carbon capture technology has been developed since the 1990s.

An ESG strategy that seeks to exclude certain companies might well miss out on this accumulated knowledge and technology. We believe such an approach to ESG is hollow. Collective knowledge and history are crucial to problem solving and as such blanket exclusions are not useful.

Over the coming years, Aker Horizons intends to invest 100bn NOK (approx. $12bn) in “planet positive” investments. In doing this, they are targeting the removal of 25 million tonnes of Co2 per year by 2025 which is equivalent to half of Norway’s total annual emissions.

As and when Aker achieves these lofty ambitions, we think it will serve as a valuable case study for how AVI thinks about ESG. Not only will success here add credence to the idea that exclusionary conceptualizations of ESG are sub-optimal, but also to the idea that families interested in long-term wealth creation and preservation are natural stewards of the environment and will aim to create value in a sustainable way. For over 35 years, AVI has benefited from investing alongside families to outperform global equity markets. We are therefore optimistic that such family run businesses will rise to the challenge and capture opportunities over the next 35 years.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU. AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

To the extent that material on this website is issued in the UK, it is issued for the purposes of the Financial Services and Markets Act 2000

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website. The information on this website is subject to change without notice.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

This website is primarily intended for United Kingdom (“UK”) residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution, publication or use would be contrary to local law or regulation or in which AVI does not hold any necessary licence or registration. Individuals or entities in respect of whom such prohibitions apply, must not access or use the AVI website.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied.

Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility and liability for the content on third party sites.

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error. You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange. Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting your investment.

Applications to invest in AVI Global Trust referred to on this website, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents.

If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU.

AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website.The information on this website is subject to change without notice.

This website is primarily intended for UK residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution or use would be contrary to local law or regulation.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied. Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility for the content of third party sites

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error.

You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange.

Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting affecting your investment.

Applications to invest in AV Global Trust referred to on this Site, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

INVESTOR – Risk Warnings

It is very important that you read this warning and disclaimer before proceeding, as it explains certain legal and regulatory restrictions applicable to any investment services and products we provide.

The content of this website is issued by Asset Value Investors Ltd (“AVI”), 2 Cavendish Square, London W1G 0PU

AVI is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom.

This website is not directed at any person in any jurisdiction where it is illegal or unlawful to access and use such information. AVI disclaims all responsibility if you access any information in breach of any local law or regulation. All persons who access this website are required to inform themselves and to abide with all applicable local law, regulations and restrictions.

The information on this website is not directed at any person or entity in the United States, and this site is not intended for distribution or to be used by any person or entity in the United States unless those persons or entities are existing investors in funds managed by AVI and they have applicable US exemptions.

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

The funds referred to in this website are alternative investment funds (“AIFs”). The promotion of such funds and the distribution of offering materials in relation to such funds is accordingly restricted by law.

Shares in the funds mentioned in this website are not dealt in or on a recognised or designated investment exchange, nor is there a market maker in such shares, and it may therefore be difficult for an investor to dispose of his shares.

The information on this website is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by AVI.

An application for shares in any of the funds referred to on this site should only be made having fully read the relevant prospectus and most recent financial statement and semi-annual financial statements published thereafter.

The Information is provided for information purposes only and on the basis that you make your own investment decisions and do not rely upon it.

AVI is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.

Should you have any queries about the investment funds referred to on this website, you should contact your financial adviser.

Past performance is not an indication of future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested.

The funds noted in this website may be subject to higher risk and volatility than other funds and may not be suitable for all investors. These funds are not regulated.

Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

The levels and bases of and reliefs from taxation may change. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. Investors should consult their own tax adviser in order to understand any applicable tax consequences.

The information on this website, including any expression of opinion or forecast, has been obtained from, or is based on, sources believed by AVI to be reliable, but are not guaranteed as to their accuracy or completeness and should not be relied upon.

You should be aware that the Internet is not a completely reliable transmission medium. AVI does not accept any liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to any direct, indirect or consequential damage, arising out of the use of the products or services referred to herein. This does not exclude or restrict any duty or liability that AVI has to its customers under the regulatory system in the United Kingdom.

To make a complaint about this website ,please send a written complaint for the attention of the Compliance Officer at the registered address: 2 Cavendish Square, London W1G 0PU.

You agree to indemnify, defend, and hold harmless AVI, its affiliates and licensors, and the officers, partners, employees, and agents of AVI and its affiliates and licensors, from and against any and all claims, liabilities, damages, losses, or expenses, including legal fees and costs, arising out of or in any way connected with your access to or use of this website and the Information.

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party websites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party websites.

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Nothing on this site should be considered as granting any licence or right under any trademark of AVI or any third party.

Deliberate misuse of any element of this Website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the Website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations. You irrevocably waive any right to a jury trial in any dispute or proceeding arising from the use of this site.