Korea is a market that AVI has long followed; the prevalence of companies with complex holding structures and the country’s deep equity market, home to many globally leading companies across a number of industries, alongside structural undervaluation, have made it an interesting proposition. With that said, although we have episodically made investments in Korea over the last 15 years, it is generally a market we have struggled to become excited about. Corporate governance, particularly from the chaebols, has been atrocious, and this has been a stumbling block.

However, this has all changed, and at speed. In the last 8 months we have built a 15% position[1] in AVI Global Trust plc and 20% in AVI Global Special Situations.

Our change in conviction has been driven by recent political changes under President Lee Jae-myung, notably amendments to the Commercial Act which significantly strengthen shareholder rights and signal potentially deeper and more substantive changes. Coupled with rising shareholder activism, we believe this evolving governance landscape offers fertile ground for AVI’s style of engaged, activist investing — an approach we successfully honed over the past decade in Japan.

South Korea’s economic ascent following the Korean War was deemed a miracle, as the country rapidly transformed from an agrarian society to the high-tech industrial powerhouse responsible for cutting edge semiconductors, smartphones display panels and consumer electronics.

Central to this remarkable transformation were the chaebols, sprawling family-controlled conglomerates like Samsung, LG, Hyundai, and SK Group. Through strategic partnerships with successive governments, the chaebols became Korea’s primary engines for growth, and in return received numerous subsidies, preferential loans, tariff protection and tax incentives. Consequently, this collaboration concentrated immense power around a handful of chaebol families.

However, Korean chaebols have become synonymous with entrenched corporate governance issues, and their long-standing track record of related-party transactions, minority shareholder exploitation, opaque financial structures, and poor capital allocation policies does little to assuage the concerns of investors.

Over the last decade, attitudes to corporate governance have slowly improved, however, and there are increasing signs that attitudes towards shareholders are shifting.

High-profile examples of better governance practices are emerging: Samsung Electronics has announced regular dividend increases and share buybacks, Samsung Biologics completed the spin-off of Samsung Epis Holdings at a fair merger ratio, while Hyundai Motor Group and SK Group have taken steps to simplify ownership structures and spin off non-core assets.

The steady rise of domestic activist funds and the willingness of foreign investors to engage more assertively with management teams have also contributed to this change in tone. Perhaps most importantly, there is a growing recognition within chaebol leadership that corporate value creation and shareholder alignment are no longer optional, but essential to attracting capital, maintaining competitiveness, and securing long-term control.

These green shoots of reform offer the potential for a meaningful re-rating of Korean equities if built-upon, and should mark a turning point for investors who long avoided the market due to previous governance issues.

Aside from corporate governance tailwinds, structural undervaluation has aided our conviction. As of December 2025, the KOSPI trades at approximately 1.4x[2] forward price-to-book, substantially below both the emerging market and developed market averages of 2x and 3.5x, respectively. This measly valuation of Korean equities extends broadly across all sectors, with approximately 70% of KOSPI-listed stocks trading below book value and around 40% trading below 0.5x book value. Additionally, foreign ownership of Korean equities remains historically low at approximately 36%[3], significantly trailing comparable Asian markets such as Taiwan, where foreign ownership exceeds 50%[4].

The market remains disproportionately weighted towards a handful of large conglomerates, notably Samsung Electronics (approximately 33% of the MSCI Korea including its preference shares) and SK Hynix (18%), together comprising 51% of the index[5]. In contrast, the Magnificent Seven, whose increasing concentration in the S&P 500 has raised concerns by global investors – accounts for 34% of the index[6].

Not only does this concentration led to diminished market liquidity, but it significantly reduces institutional investor choice when allocating to Korea, limiting diversification opportunities for many sizeable investors.

The limited presence of major global investment banks covering Korean equities compounds these issues. In contrast to other Asian markets such as Taiwan and Japan, which benefit from extensive international analyst coverage, Korean stocks predominantly rely on domestic brokerage firms for research, which is often only conducted in Korean. This domestic-centric coverage approach limits global investor visibility and exacerbates informational asymmetries, intensifying undervaluation.

At the end of January 2026, 60% of the KOSPI index had 0 sell-side coverage, and 68% had less than two brokers.[7]

The magnitude of Korea’s valuation discount, combined with limited sell-side research and general market awareness, creates a uniquely rich stock-picking environment, with foreign ownership levels much lower than average.

AVI believes that the election of President Lee in 2025 marks a crucial turning point for the Korean market.

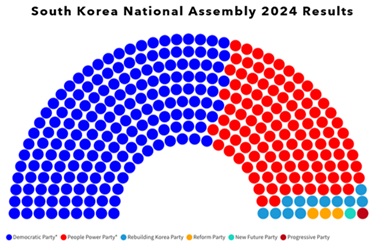

Lee’s Democratic Party of Korea (DPK) holds a commanding majority of 175 seats (out of 300) in the National Assembly, granting a virtually unimpeded legislative pathway until at least April 2028. This essentially makes him one of the most powerful President’s that Korea has ever had.

Learning from the failures of Corporate Value Up in 2024, President Lee’s election campaign explicitly prioritised corporate governance reform, promising legislative amendments to rectify longstanding issues of chaebol dominance, minority shareholder abuse, and low dividends, and he has been quick and effective to start enacting reforms.

The South Korean government has already passed two Commercial Act amendments with significant teeth. The first (July 2025) expanded directors’ fiduciary duty from serving “the company” to serving “the company and all shareholders,” exposing board members to minority shareholder liability. It also mandated electronic shareholder meetings from January 2027 and strengthened the 3% voting cap for audit committee elections. The second amendment (August 2025) introduced mandatory cumulative voting for companies exceeding ₩2 trillion in assets from September 2026, preventing controlling shareholders from unilaterally appointing all directors, and required at least two independently elected audit committee members. In December 2025, dividend income tax reform passed, reducing the top marginal rate from 49% to 30% for qualifying companies which maintain either a 40%+ payout ratios or 25%+ with 10% year-over-year increases through for the last three years. A third amendment mandating treasury share cancellation is also expected to pass in Q1 2026.

AVI’s investment philosophy is grounded in the belief that capital markets frequently misprice complexity, particularly in markets where corporate governance is opaque, asset transparency is low, or conglomerate structures obscure underlying value. We specialise in identifying these inefficiencies, through a bottom-up, research-intensive process that focuses on discovering companies trading at material discounts to intrinsic value. Our investments are typically catalysed by engagement—but always supported by a strong underlying business case that allows us to be long-term holders, regardless of engagement outcomes.

The Korean equity market exemplifies this thesis in practice. The market’s deeply entrenched chaebol structures, pervasive cross-shareholdings, and persistent capital misallocation, create fertile ground for the types of inefficiencies AVI is adept at uncovering, and numerous Korean companies exhibit the hallmarks of our investable universe.

AVI’s Korea strategy is rooted in our long-term commitment to the companies we invest in and our collaborative approach to engagement with management teams.

Our experience in engaging with Japanese companies over the past eight years has taught us that private, respectful, and constructive dialogue often has a greater level success than public activism, and generates a deeper relationship with the management and boards of our portfolio companies. We intend to apply this same approach to Korea, recognising that cultural sensitivity, patience, and alignment with management are critical to achieving lasting results.

We focus our engagement not only on capital efficiency and corporate governance—common angles for activist investors—but also on driving operational improvements that enhance long-term corporate value. Rather than simply calling for share buybacks or higher dividends, we highlight a comprehensive range of improvements across operations, governance, shareholder communications, and capital allocation.

Our ability to engage constructively has been shaped by the success of our Japan engagement strategy, where our thoughtful and long-term approach has been well-received by management teams and reflected in performance.

We bring this same mindset to Korea, believing that by positioning ourselves as an aligned, value-enhancing partner, we can help unlock significant latent value in the Korean market. This method stands in contrast to more aggressive, unsuccessful activism attempts by western investors in Korea historically, and underscores our belief that deep research, cultural awareness, and long-term commitment are key to successful engagement.

Our allocation of over 15% versus the MSCI World ACWI of less than 1% demonstrates the opportunity we see in Korea, and we hope that you, our investors, will join us at this exciting time.

Ross McGarry, CFA, Senior Investment Analyst at Asset Value Investors

February 2026

[1] As at 31 January 2026

[2] All market pricing data sourced from capital IQ as at 31/12/25

[3] Korea Exchange as at 31/12/25

[4] CLSA as at 31/12/25

[5] MSCI Korea Factsheet as at 31/12/25

[6] Factset as at 31/12/25

[7] Capital IQ as at 31/12/25

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU. AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

To the extent that material on this website is issued in the UK, it is issued for the purposes of the Financial Services and Markets Act 2000

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website. The information on this website is subject to change without notice.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

This website is primarily intended for United Kingdom (“UK”) residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution, publication or use would be contrary to local law or regulation or in which AVI does not hold any necessary licence or registration. Individuals or entities in respect of whom such prohibitions apply, must not access or use the AVI website.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied.

Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility and liability for the content on third party sites.

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error. You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange. Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting your investment.

Applications to invest in AVI Global Trust referred to on this website, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents.

If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU.

AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website.The information on this website is subject to change without notice.

This website is primarily intended for UK residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution or use would be contrary to local law or regulation.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied. Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility for the content of third party sites

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error.

You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange.

Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting affecting your investment.

Applications to invest in AV Global Trust referred to on this Site, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

INVESTOR – Risk Warnings

It is very important that you read this warning and disclaimer before proceeding, as it explains certain legal and regulatory restrictions applicable to any investment services and products we provide.

The content of this website is issued by Asset Value Investors Ltd (“AVI”), 2 Cavendish Square, London W1G 0PU

AVI is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom.

This website is not directed at any person in any jurisdiction where it is illegal or unlawful to access and use such information. AVI disclaims all responsibility if you access any information in breach of any local law or regulation. All persons who access this website are required to inform themselves and to abide with all applicable local law, regulations and restrictions.

The information on this website is not directed at any person or entity in the United States, and this site is not intended for distribution or to be used by any person or entity in the United States unless those persons or entities are existing investors in funds managed by AVI and they have applicable US exemptions.

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

The funds referred to in this website are alternative investment funds (“AIFs”). The promotion of such funds and the distribution of offering materials in relation to such funds is accordingly restricted by law.

Shares in the funds mentioned in this website are not dealt in or on a recognised or designated investment exchange, nor is there a market maker in such shares, and it may therefore be difficult for an investor to dispose of his shares.

The information on this website is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by AVI.

An application for shares in any of the funds referred to on this site should only be made having fully read the relevant prospectus and most recent financial statement and semi-annual financial statements published thereafter.

The Information is provided for information purposes only and on the basis that you make your own investment decisions and do not rely upon it.

AVI is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.

Should you have any queries about the investment funds referred to on this website, you should contact your financial adviser.

Past performance is not an indication of future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested.

The funds noted in this website may be subject to higher risk and volatility than other funds and may not be suitable for all investors. These funds are not regulated.

Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

The levels and bases of and reliefs from taxation may change. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. Investors should consult their own tax adviser in order to understand any applicable tax consequences.

The information on this website, including any expression of opinion or forecast, has been obtained from, or is based on, sources believed by AVI to be reliable, but are not guaranteed as to their accuracy or completeness and should not be relied upon.

You should be aware that the Internet is not a completely reliable transmission medium. AVI does not accept any liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to any direct, indirect or consequential damage, arising out of the use of the products or services referred to herein. This does not exclude or restrict any duty or liability that AVI has to its customers under the regulatory system in the United Kingdom.

To make a complaint about this website ,please send a written complaint for the attention of the Compliance Officer at the registered address: 2 Cavendish Square, London W1G 0PU.

You agree to indemnify, defend, and hold harmless AVI, its affiliates and licensors, and the officers, partners, employees, and agents of AVI and its affiliates and licensors, from and against any and all claims, liabilities, damages, losses, or expenses, including legal fees and costs, arising out of or in any way connected with your access to or use of this website and the Information.

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party websites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party websites.

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Nothing on this site should be considered as granting any licence or right under any trademark of AVI or any third party.

Deliberate misuse of any element of this Website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the Website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations. You irrevocably waive any right to a jury trial in any dispute or proceeding arising from the use of this site.