* As of 31 January 2026

** As of 30 April 2025

Together with the Annual Report for the year ended 30 April 2024, shareholders should also note the document entitled “2024 Realisation Opportunity” which is available under “Disclosures” together with a Form of Election for shareholders who wish to realise some or all of their shares.

More information on the 2024 Realisation Opportunity can be found in the annual report, in particular the Chairman’s Statement, the Business Report, the Directors’ Report and the Notice of AGM together with Explanatory Notes thereto.

| 31 December 2025 | % of NAV |

|---|---|

| VH Global Energy Infrastructure | 9.4 |

| Gresham House Energy Storage | 8.6 |

| Chrysalis Investments | 7.7 |

| Baker Steel Resources Trust | 7.1 |

| Harbourvest Global PE | 6.3 |

| Pantheon International | 5.8 |

| GCP Asset Backed Income Fund | 5.3 |

| Georgia Capital | 4.9 |

| Sherborne Investors C | 4.7 |

| US Solar Fund | 4.5 |

| Total | 64.3 |

MIGO Opportunities Trust (MIGO) was established in 2004 to invest in closed-ended opportunities. The trust was previously run by Premier Miton plc before moving to Asset Value Investors in 2023.

At MIGO, we believe that integrating ESG and sustainability factors into our investment process, alongside traditional financial factors, is important to enable us to deliver strong and durable performance to our clients and to meet our broader investment responsibilities. ESG matters, including climate change, are part of our analysis and risk assessment when deciding whether an investment should be made. Climate change poses both risks and opportunities. The transition to a low-carbon economy will affect all businesses, irrespective of their size, sector, or geographic location. Therefore, no company’s revenues are immune, and the assessment of such risks must be considered within any effective investment approach.

As active investors, once we have invested in a company, we take our stewardship responsibilities seriously. MIGO acknowledges that it can have an indirect impact on communities and the environment through the companies it holds in its portfolio. We look to engage with boards and management on an ongoing basis and create an active dialogue on various ESG factors. Often, engagement with investee boards is undertaken with a view to helping realise value or to address potential issues with governance. We seek to ensure good governance practices are being upheld and encourage adherence to responsible and ethical conduct. MIGO also views voting at company meetings to be an important lever in our stewardship responsibilities and will vote at company meetings when we have the opportunity to do so.

See the sections below for further insights into the ESG work at MIGO

AVI has developed a proprietary ESG monitoring system that allows us to track the extent to which our portfolio companies are effectively managing ESG issues and their progress against defined ESG metrics. This process helps to highlight trends and identify weaknesses where we can engage constructively with companies to build resilience to ESG risks and promote responsible business practices.

AVI became a signatory to the UN-supported Principles for Responsible Investment (PRI) on 09 April 2021.

We are aligned with the PRI’s belief that an economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.

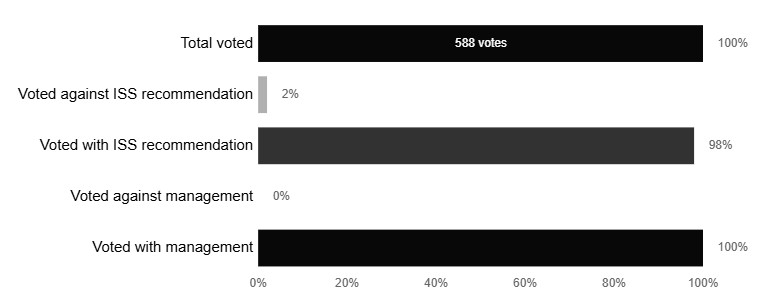

We consider proxy voting to be an important lever in engaging with our portfolio companies and ensuring that our perspectives on environmental, social and governance issues are represented.

As responsible, active stewards of our clients’ capital, we have a duty to vote carefully and thoughtfully on their behalf, and we take this duty seriously. We aim to vote at every general meeting for which we are eligible.

The AIC has also produced a guide to investment trusts for people who want to learn more about the key concepts of investing, the advantages of using diversified funds to invest and the specific features of investment companies.

IMPORTANT INFORMATION

USE OF THIS WEBSITE:

THIS WEBSITE IS NOT INTENDED TO OFFER OR TO PROMOTE THE OFFER OR SALE OF THE SHARES (THE “SHARES”) OF MIGO OPPORTUNITIES TRUST PLC (THE “COMPANY”) IN THE UNITED STATES OR TO ANY “U.S. PERSONS” AS DEFINED IN REGULATION S (“US PERSONS”) UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”).

THE MATERIALS CONTAINED HEREIN ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, AND MUST NOT BE MADE AVAILABLE, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR IN ANY OTHER JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE LAW OR REGULATION.

The contents of this website are communicated by Asset Value Investors Limited (“AVI”), which is authorised and regulated by the UK Financial Conduct Authority, with registered number 01881101 and which has its registered office at 2 Cavendish Square, London W1G 0PU, United Kingdom.

The information contained in this website does not constitute or form a part of any offer to sell or issue, or the solicitation of any offer to purchase, subscribe for or otherwise acquire, any securities in the United States or in any jurisdiction in which, or to any person to whom, such an offer or solicitation would be unlawful.

Nothing in this website is to be taken as investment or tax advice. If you are unclear about any of the information on this website or its suitability for you, you must contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The Company has not been and will not be registered under the US Investment Company Act of 1940, as amended (the “Investment Company Act“), and as such holders of the Shares are not and will not be entitled to the benefits of the Investment Company Act. The Shares have not been and will not be registered under the Securities Act, or with any securities regulatory authority of any state or other jurisdiction of the United States, and may not be offered, sold, resold, pledged, delivered, assigned or otherwise transferred, directly or indirectly, into or within the United States or to, or for the account or benefit of, any US Persons. There has been and will be no public offer of the Shares in the United States. The offer and sale of the Shares have not been and will not be registered under the applicable securities laws of Australia, Canada, Japan or South Africa. Potential users of the information contained in this website are requested to inform themselves about and to observe all applicable restrictions.

General risk warning: All investment is subject to risk. The value of the Shares may go down as well as go up. Past performance is no guarantee of future returns and there is no guarantee that the market price of the Shares will fully reflect their underlying net asset value. There is also no guarantee that the Company’s investment objective will be achieved.

The information contained in this website may contain forward-looking statements. Any statement other than a statement of historical fact is a forward-looking statement. Actual results may differ materially from those expressed or implied by any forward-looking statement. You should not place undue reliance on any forward-looking statement.

Neither the Company nor AVI undertakes any obligation to update or revise any information in this website, including without limitation, any forward-looking statements, whether as a result of new information, future events or otherwise, and neither the Company nor AVI will confirm the accuracy or completeness of any information at any given time.

This website may contain links to third party websites. These links are provided for your information and convenience only, and do not amount to a recommendation or endorsement by the Company or AVI of that third party or its website. Neither the Company nor AVI has any control over the content of any third party website and neither the Company nor AVI has verified the accuracy of any content on any third party website. Accordingly, neither the Company nor AVI is liable for the content or availability (or lack of availability) of such third party websites.

This website is provided for your use “as is” without any warranties (whether express or implied) of any kind including, but not limited to, the warranty of non-infringement of third party rights or freedom from computer virus. As a result, neither the Company nor AVI accepts any ongoing obligation or responsibility in respect of any errors, omissions, interruptions or delays in service which may occur. Internet is not a secure medium of communication unless the data being sent is encrypted. Neither the Company nor AVI accepts any responsibility for unauthorised access by a third party or the corruption of data sent to it.

By continuing to use this website, you agree to the exclusion by the Company and AVI, to the extent permitted by applicable law and regulation, of any and all liability for any direct, indirect, punitive, consequential, incidental, special or other damages, or any loss of profits, revenue or data arising out of or relating to your use of and our provision of this website and its content. The Company may change these terms and conditions from time to time and any such changes will be posted on this website. Your access to this website is governed by the version of these terms and conditions then in force.

By clicking “Agree” below, you represent, warrant, undertake and agree that (1) you have read, understood and agree to be bound by the terms and conditions and other information set out herein, (2) you are permitted under applicable laws and regulations to receive the information contained in this website, (3) you are located outside the United States and are not a US Person, and (4) you will not transmit or otherwise send any information contained in this website to any persons in the United States or who are US Persons or to any publications with a general circulation in the United States. If you cannot so represent, warrant, undertake and agree, you must click the button labelled “Decline” or otherwise exit this website.

Over January 2026 MIGO’s NAV remained flat, the share price was up 1.9% and the discount sat at 1.3%. In light of MIGO’s increased concentration and engagement with investee companies, we have decided to cease publishing our top ten holdings and providing commentary on a monthly basis. Going forward, we will do so quarterly.

The next newsletter to contain the top ten and portfolio commentary will be as at 31-Mar-26. The MIGO management team remain available for shareholder meetings – please contact info@assetvalueinvestors.com

This is the first quarterly newsletter under our new reporting format. In light of MIGO’s increased concentration and engagement with investee companies, we ceased publishing our top ten holdings and providing commentary on a monthly basis from Oct-25 onwards. While intra-quarter monthly newsletters are still being produced, they are limited to statistical updates on performance, gearing levels, etc.

The fourth quarter 2025 was a good one for MIGO with our NAV increasing by +3.9%. For reference only, given our portfolio has very little in common with the major equity indices, the MSCI AC World Index was up +3.4% and the Deutsche Numis Small Companies Including Investment Trusts Index was up +2.9%. MIGO’s share price increased by +5.3% as the discount narrowed to -3.2% (all returns are in GBP).

MIGO’s monthly NAV total returns within the quarter were +2.8% for Oct-25; -0.8% for Nov-25; and +1.9% for Dec-25.

Over November 2025 MIGO’s NAV returned -0.8%, the share price was down 2.6% and the discount sits at 6.2%. In light of MIGO’s increased concentration and engagement with investee companies, we have decided to cease publishing our top ten holdings and providing commentary on a monthly basis. Going forward, we will do so quarterly.

The next newsletter to contain the top ten and portfolio commentary will be as at 31-Dec-25. The MIGO management team remain available for shareholder meetings – please contact info@assetvalueinvestors.com

Over October MIGO’s NAV returned 2.8%, the share price was up 2.8% and the discount sits at 4.5%. In light of MIGO’s increased concentration and engagement with investee companies, we have decided to cease publishing our top ten holdings and providing commentary on a monthly basis. Going forward, we will do so quarterly. The next newsletter to contain the top ten and portfolio commentary will be as at 31-Dec-25. The MIGO management team remain available for shareholder meetings – please contact info@assetvalueinvestors.com

September 2025 was a bumper month for mainstream indices. Both the S&P 500 and the MSCI AC World were up over 4% in the month. Even in the UK the FTSE All-Share returned nearly 2%. MIGO’s NAV was up 0.9% and the share price was down 0.3% (all figures in GBP). Our underlying equity exposure is low with performance likely to be lumpy and driven by idiosyncratic corporate events at portfolio holdings. Our expectation is that we will likely underperform in periods where equity markets are strong, and outperform in sideways and down markets, with our aim to achieve outperformance over a cycle with low correlation. We remain excited by the portfolio we have assembled, with clear identifiable catalysts spread across the key holdings.