Since 1985, AVI have followed the same distinctive bottom-up approach to global equities.

We look for three things:

Family-controlled holding companies have been at the heart of the portfolio for this entire period. At AVI’s inception, there were several French holding companies that had complex cascade structures that attracted discounts upon discount.

We were able to align capital with thoughtful, long-term orientated families, that owned attractive quality assets, with significant upside potential from discount narrowing and corporate restructuring.

These same fundamental attractions remain at the heart of our approach today.

The decade that’s been:

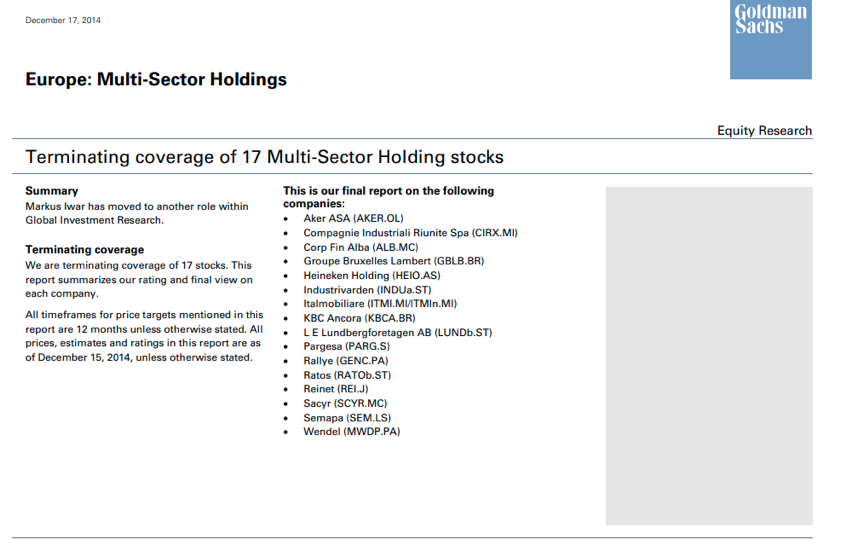

Just over a decade ago, in December 2014, Goldman Sachs dropped research coverage of European holding companies.

An innocuous event, which meant very little for most participants in financial markets.

For us however, it was symbolic of the environment.

For the last decade, investor attention has been funnelled toward large-cap global equities generally, and a handful of US technology stocks specifically. The world of holding companies has become more irrelevant than ever. We believe such circumstances create a perfect environment for fundamental stock picking. In this paper we aim to shed light on the overlooked and misunderstood world of family-controlled holding companies.

So why are holding companies so misunderstood?

Complex structures:

Family holding company structures are often complex. They can have multiple share classes with differing rights; or they might form part of a cascade, where one holding company owns another holding, creating discount upon discount. Such structures often don’t “screen” well, and as such the underlying economics and value may not be captured in a cursory glance.

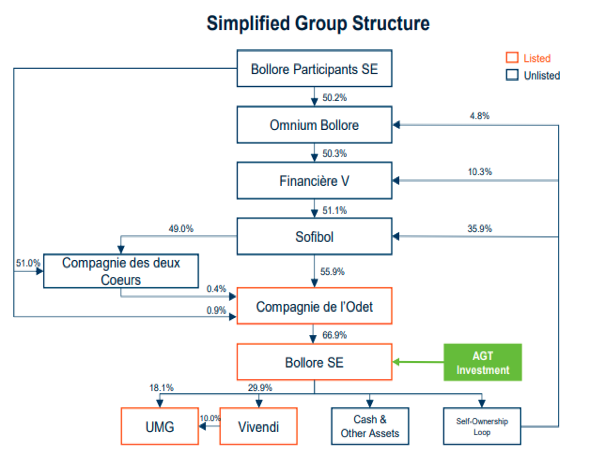

Example case study – Bollore SE (1.9% weight in AVI Global Trust)

Churchill wasn’t taking about Bollore SE when he uttered the phrase “a riddle wrapped in a mystery inside an enigma” – but he might as well have been.

The Bollore Group structure is notoriously and (in) famously complex, with multiple layers of holding company and a so-called Bretton Pulley system whereby there are circular loops in ownership. The structure has allowed Vincent Bollore – who bought the family business back from the banks for 1 solitary franc in the 1980s – to build a powerful empire, maintaining control with limited capital outlay.

Today the structure means that in-effect the true economic shares outstanding are less than half that are publicly stated. This obfuscates value and leads to discount upon discount across different layers of the structure. What you see is not what you get. We believe there is scope for the structure to be simplified in accretive ways, and in the meantime Bollore offers exposure to Universal Music Group – an attractive, growing business – at a discounted valuation.

Holding companies are typically under-researched. With diverse portfolios of assets across sectors, such companies do not fit neatly into different research teams’ buckets. Moreover, with small free-floats and low probability of equity issuance, the economic incentive to promote such stocks is limited. These trends have been compounded by changes in market structure over the last decade, as investor attention and capital has flooded toward larger cap index companies.

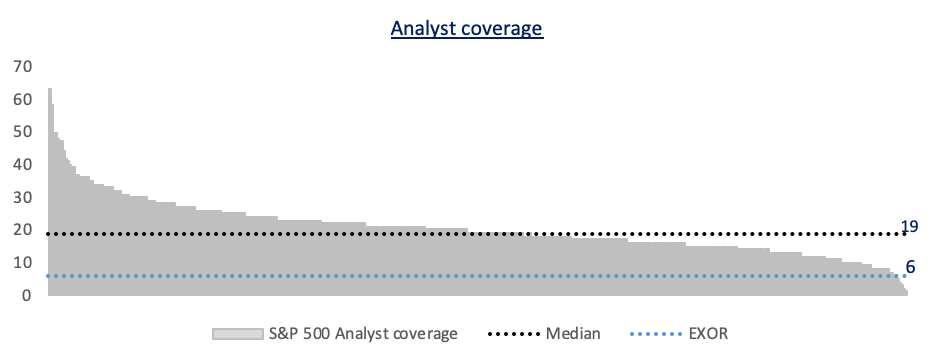

Example case study – EXOR (2.3% weight)

EXOR – the Agnelli family controlled holding company – is one of Europe’s largest family-controlled holding companies, with a NAV of some €37bn.

Yet it has just 6 analysts who cover it. This compares to a median number of 19 for companies in the S&P 500 and Amazon – the most widely covered – with a whopping 63.

We like to look where others aren’t – in places where mispricing’s are more likely occur.

The lack of research particularly comes to the fore when it comes to unlisted assets, the valuation of which are less certain by their very definition. We do some of our best work when we can build a differentiated view on the value of an unlisted asset and then look for events – such as an IPO or sale – to validate this valuation and make the market wake up and re-value it.

Example case study – D’Ieteren (7.0% weight)

A seventh-generation Belgian holding company hardly sounds like the place to find an attractive investment (and hence many aren’t looking there), but for the beady eyed there is much on offer.

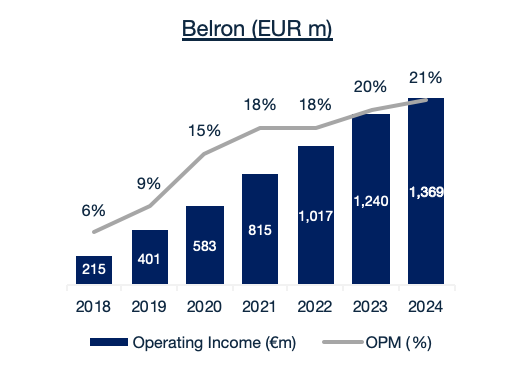

D’Ieteren (said seventh-generation holding company and currently a 7.0% weight in the portfolio) owns a 50% stake in Belron, which readers might be more familiar with as Autoglass (UK), Safelite (US) or Carglass (EU). Belron is many multiples larger than competitors, with >40% US market share, giving it significant scale advantages in terms of purchasing economies of scale and cost leadership, relationships with insurance partners who are industry gatekeepers, and technological investment, which has become increasingly relevant.

Increased windshield complexity and the requirement for Advanced Driver Assistance System (“ADAS”) cameras to be recalibrated upon replacement, has re-accelerated top-line growth and taken margins from 6% in 2018, when we visited the European Distribution Centre in Bilzen, to north of 21% today. Over this time period, private equity investors have bought stakes in Belron at an initial valuation of €3bn in 2018 up to €32.2bn in 2024. At this latest valuation, D’Ieteren’s 50% stake is worth €221 per D’Ieteren share, versus the current share price of €159. Over time, we expect further sales or an IPO to crystallise this value and support a re-rating in D’Ieteren’s shares.

As the name suggests, family-controlled holding companies have large family ownership stakes. The consensus view on such situations is one of scepticism. However, we take the other view, and believe the market underappreciates the attractiveness of aligning capital with long-term orientated families, who think in generations rather than quarters. In many ways we think of families as being their very own “activists”, driving change and creating value for all shareholder through active portfolio management.

Example case study – Aker (4.5% weight)

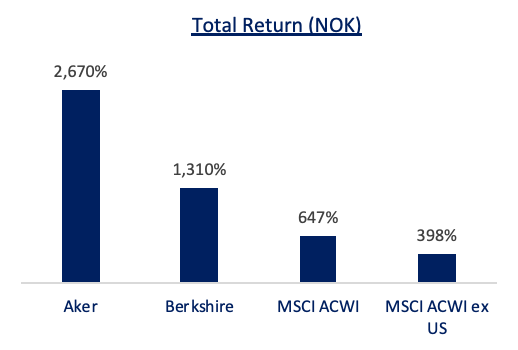

In 1996 Kjell Røkke became the largest shareholder in Aker – an industrial group dating back to the 1840s. Aker re-listed in 2004 and has subsequently achieved annualised shareholder total returns of +17.6%.

These strong returns have been built on active portfolio management and deal making, principally in oil and gas and related sectors. In the early years, Aker’s performance was built on the boom in oilfield services, followed over the last decade by growth in oil exploration and production (“E&P”). This culminated in the creation of Aker BP – the product of a merger between Det Norske and BP subsidiary BP Norge – in 2016. Aker BP has continued to grow both organically and in-organically, acquiring assets from Hess in 2017 and Lundin Energy’s E&P business in 2022. Over the last year, we have seen increasingly dynamic capital realisation and allocation at the Aker ASA holding company level, streamlining assets and unlocking value – for instance through the splitting in two of Aker BioMarine to realise value from the Feed Ingredients business.

This more focused Aker has allowed for increased shareholder returns, with the company targeting 4-6% of NAV in annual dividend payments. On the current share price, this equates to a yield of ~9%. We believe this to be good value.

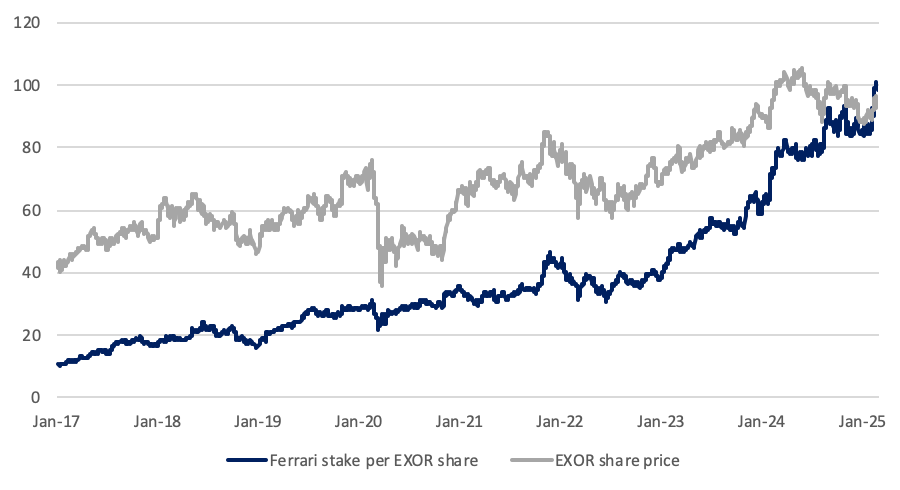

Since 2016 we have been shareholders in EXOR – the holding company of the Italian Agnelli family. As a company and as a stock we believe it provides an interesting lens into the world of family-controlled holding companies.

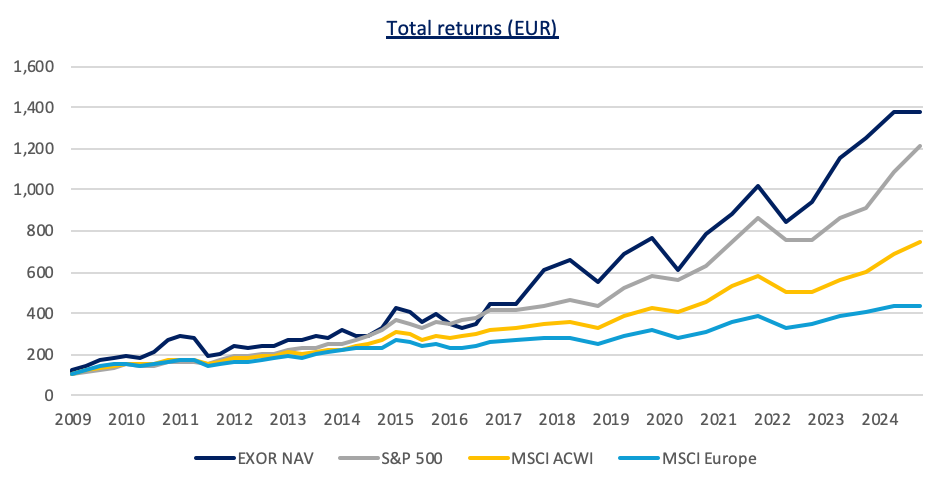

EXOR was established in 2009 by the merging of two companies (IFIL & IFI). John Elkann – the great grandson of Fiat’s founder – is the CEO, and has built an enviable track record of returns, compounding NAV well in excess of global equity markets.

Akin to Aker discussed above and like all the best holding companies, EXOR, under John Elkann’s leadership, has adopted an active approach to unlocking value.

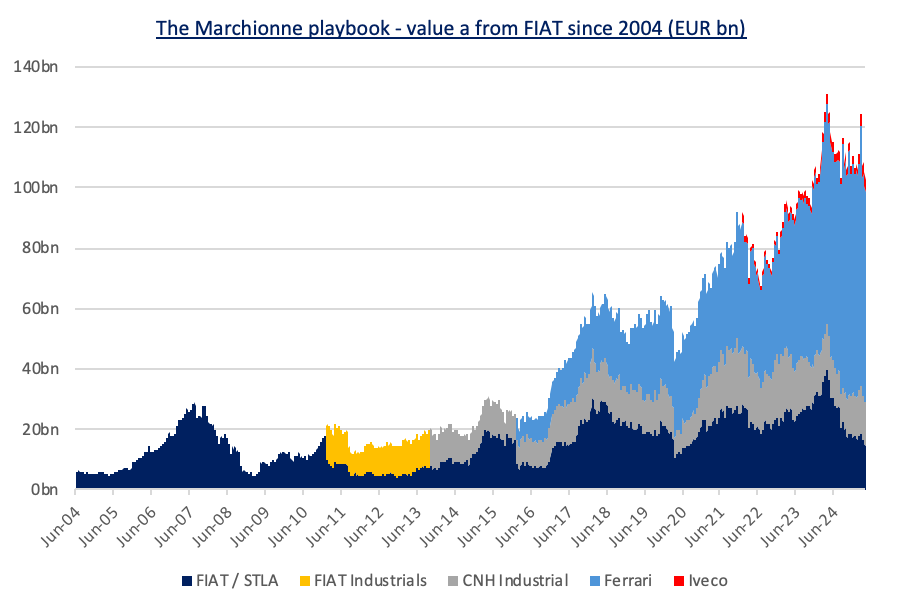

This is best demonstrated from the returns that have been extracted from what was once Fiat. In 2006, when the late-great Sergio Marchionne was appointed Fiat’s CEO, the company had a market cap of €5.5bn. Today Stellantis – as it subsequently became – and the entities that have been spun off – Ferrari, CNH Industrial and more latterly Iveco – have a combined market value of just north of €100bn. This equates to an 19x return or CAGR of +15.1%.

Alas for us, we have not benefited from the full extent of this 19x return!

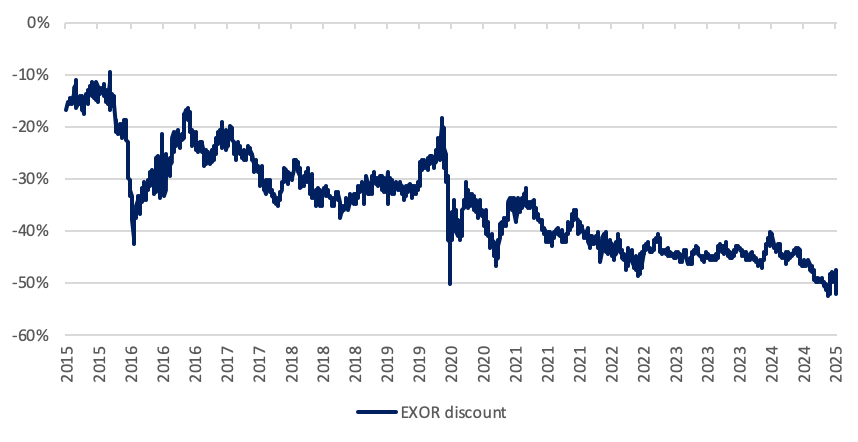

We started to build a position a position in 2016. At the time, this was predicated on the undervaluation of what was then Fiat Chrysler and the potential for significant value creation through consolidation of the Autos industry (as Sergio Marchionne had laid out in his Confessions of a Capital Junkie). In addition to the attractive NAV growth prospects from Ferrari, which we thought to be an exceptional, but probably fairly priced company at 19x NTM EV/EBIT and CNH Industrial, which was at the time in the doldrums of the agriculture cycle. As well as this we were attracted to (what we then!) considered to be a wide discount of c.25% and the alignment of interest with John Elkann as a sagacious capital allocator.

Overall, it has been a moderately successful investment, generating a return of +38% and an IRR of +10%.

Well-informed readers will be aware of what we’ve got right and what we’ve got wrong.

We were right on Fiat Chrysler. We estimate that – inclusive of dividends – EXOR has more than doubled (+121%) its money from FCA since the end of 2016 – even inclusive of the current more than -50% drawdown in Stellantis shares. The merger with PSA to form Stellantis created considerable value, as platform harmonisation and the pooling of capex and R&D budgets yielded meaningful synergies. It has since become clear that the business over earned, pushing pricing and margins too far, and damaging relationships with the US dealer network. However, the bulk of our returns have come from Ferrari, where financial and operational performance has been exceptional, and the market has rewarded this with a higher valuation.

multiple to reflect the strong and durable growth. Since 2016, units, revenues and adjusted operating profit have grown +72%, +115% and +199%, respectively. Concurrently, the NTM EV/EBIT multiple has expanded to 34x. This has resulted in a more than +600% return for Ferrari’s shares.

One thing we underestimated was the extent to which EXOR’s discount could widen – from c.25% at the time of first purchase to 52% currently. Aside from a handful of days during March 2009 and again during the COVID 2020 sell-off, the current discount is the widest on record and compares a 10-year average of c.35%.

Indeed, by late February 2025 the stake in Ferrari accounted for more than 100% of EXOR’s market cap. Highlighting the proactive nature of family control, on 26th February 2025, EXOR sold 15.8% of its stake at a value of equating to ~8% of NAV and ~17% of market cap. This frees up capital for new investments and share buybacks, with the launch of a new €1bn reverse

Dutch tender offer. At current prices this equates to 6% of shares outstanding and – if conducted at the current discount – would add +2.5% to NAV, with a risk-free ROI of +95%. This is exactly the kind of capital allocation we look to align ourselves with.

Despite the management’s proactiveness, the market remains unmoved, with EXOR still languishing on an 52% discount. We believe this is emblematic of the current environment: a family-controlled holding company making smart, value-enhancing decisions, and a market that simply shrugs its shoulders and doesn’t care.

Although EXOR lacks the more distinct hard catalyst of other positions in the portfolio, we have been modestly adding to the position, intrigued by the market’s indifference.

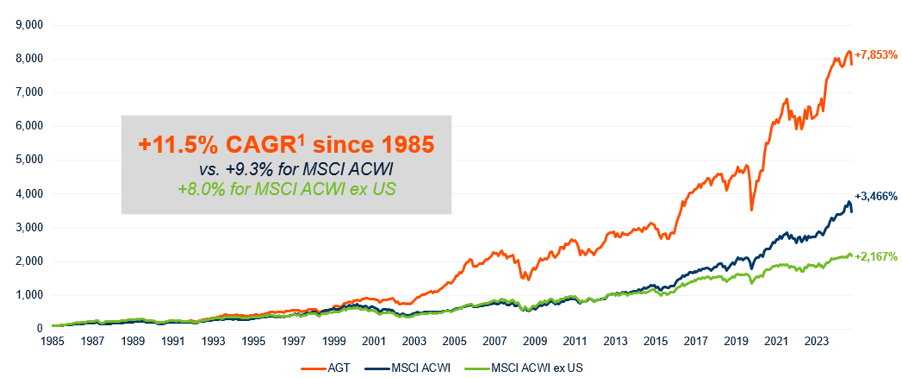

This year will mark 40 years of AVI as the investment manager of AVI Global Trust.

Over this period, we have compounded returns at +11.5%* per annum.

Family-controlled holding companies have been at the heart of our approach for this entire period.

We hope this article provides some explanation to their attractions, and the structural reasons for their undervaluation and underappreciation.

We believe these factors will likely persist into the future, providing a fertile hunting ground with our approach.

Combined with historically wide discount levels, we are optimistic about prospective long-term returns.

*Source: Morningstar, all figures to 31st March 2025 unless stated otherwise.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU. AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

To the extent that material on this website is issued in the UK, it is issued for the purposes of the Financial Services and Markets Act 2000

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website. The information on this website is subject to change without notice.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

This website is primarily intended for United Kingdom (“UK”) residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution, publication or use would be contrary to local law or regulation or in which AVI does not hold any necessary licence or registration. Individuals or entities in respect of whom such prohibitions apply, must not access or use the AVI website.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied.

Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility and liability for the content on third party sites.

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error. You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange. Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting your investment.

Applications to invest in AVI Global Trust referred to on this website, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents.

If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU.

AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website.The information on this website is subject to change without notice.

This website is primarily intended for UK residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution or use would be contrary to local law or regulation.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied. Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility for the content of third party sites

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error.

You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange.

Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting affecting your investment.

Applications to invest in AV Global Trust referred to on this Site, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

INVESTOR – Risk Warnings

It is very important that you read this warning and disclaimer before proceeding, as it explains certain legal and regulatory restrictions applicable to any investment services and products we provide.

The content of this website is issued by Asset Value Investors Ltd (“AVI”), 2 Cavendish Square, London W1G 0PU

AVI is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom.

This website is not directed at any person in any jurisdiction where it is illegal or unlawful to access and use such information. AVI disclaims all responsibility if you access any information in breach of any local law or regulation. All persons who access this website are required to inform themselves and to abide with all applicable local law, regulations and restrictions.

The information on this website is not directed at any person or entity in the United States, and this site is not intended for distribution or to be used by any person or entity in the United States unless those persons or entities are existing investors in funds managed by AVI and they have applicable US exemptions.

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

The funds referred to in this website are alternative investment funds (“AIFs”). The promotion of such funds and the distribution of offering materials in relation to such funds is accordingly restricted by law.

Shares in the funds mentioned in this website are not dealt in or on a recognised or designated investment exchange, nor is there a market maker in such shares, and it may therefore be difficult for an investor to dispose of his shares.

The information on this website is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by AVI.

An application for shares in any of the funds referred to on this site should only be made having fully read the relevant prospectus and most recent financial statement and semi-annual financial statements published thereafter.

The Information is provided for information purposes only and on the basis that you make your own investment decisions and do not rely upon it.

AVI is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.

Should you have any queries about the investment funds referred to on this website, you should contact your financial adviser.

Past performance is not an indication of future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested.

The funds noted in this website may be subject to higher risk and volatility than other funds and may not be suitable for all investors. These funds are not regulated.

Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

The levels and bases of and reliefs from taxation may change. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. Investors should consult their own tax adviser in order to understand any applicable tax consequences.

The information on this website, including any expression of opinion or forecast, has been obtained from, or is based on, sources believed by AVI to be reliable, but are not guaranteed as to their accuracy or completeness and should not be relied upon.

You should be aware that the Internet is not a completely reliable transmission medium. AVI does not accept any liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to any direct, indirect or consequential damage, arising out of the use of the products or services referred to herein. This does not exclude or restrict any duty or liability that AVI has to its customers under the regulatory system in the United Kingdom.

To make a complaint about this website ,please send a written complaint for the attention of the Compliance Officer at the registered address: 2 Cavendish Square, London W1G 0PU.

You agree to indemnify, defend, and hold harmless AVI, its affiliates and licensors, and the officers, partners, employees, and agents of AVI and its affiliates and licensors, from and against any and all claims, liabilities, damages, losses, or expenses, including legal fees and costs, arising out of or in any way connected with your access to or use of this website and the Information.

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party websites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party websites.

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Nothing on this site should be considered as granting any licence or right under any trademark of AVI or any third party.

Deliberate misuse of any element of this Website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the Website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations. You irrevocably waive any right to a jury trial in any dispute or proceeding arising from the use of this site.