In the summer of 1985 when Asset Value Investors (AVI) was appointed as manager of what was then the British Empire Trust – and is now AVI Global Trust – the world of investing looked very different. Markets were less transparent, information travelled more slowly, and the idea of active engagement with companies was far from the mainstream. The principles that guided AVI then, however, were already clear: invest patiently, focus on intrinsic value, and seek opportunities where good-quality, under-researched assets are hiding in plain sight.

Forty years later, the landscape has transformed beyond recognition. Entire markets have risen, merged and digitised. The pace of change has accelerated with technology, regulation, and the globalisation of capital. The language of investment has evolved too – stewardship, governance, and more recently sustainability[1]. Yet through every shift, the core principles of patience, rigour, and intrinsic value have proved enduring for AVI, and remain central to how we invest today.

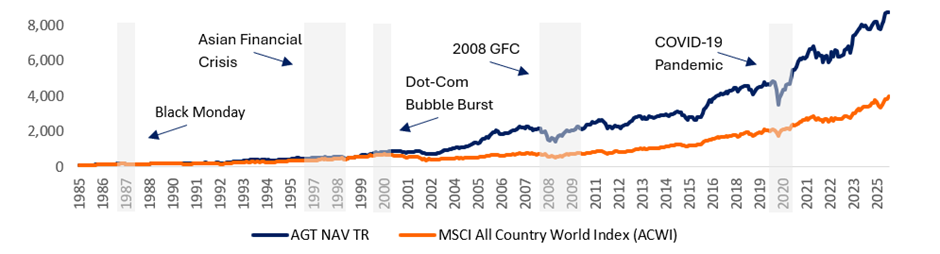

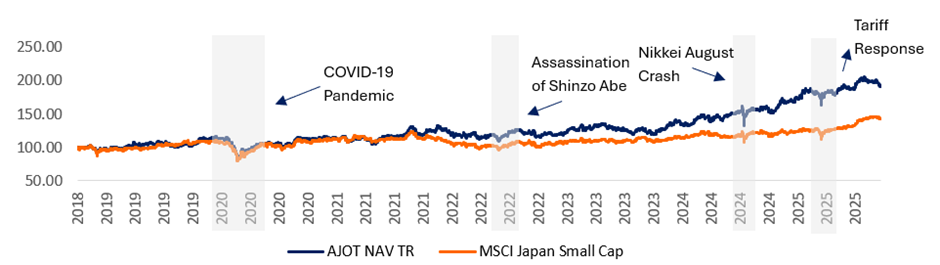

That philosophy has continued to guide us across multiple economic and valuation regimes. Since assuming management of the AVI Global Trust (AGT) in 1985 and launching the AVI Japan Opportunity Trust (AJOT); we have invested through Black Monday, the Asian financial crisis, the dot-com boom, the global financial crisis and the COVID-19 pandemic; periods that tested liquidity, patience and process. Over this long term, AGT, and since 2018, AJOT, have demonstrated resilient long-term performance (see Figure 1. and Figure 2.); driven not by leverage or style rotation, but by systematic exploitation of structural inefficiencies: discounts in holding companies, mispriced closed-end funds, and under-researched, asset-backed businesses. Our approach since 1985 has become more data-intensive and engagement-driven over time, but its foundation, the search for intrinsic value and alignment with disciplined owners, remains as it was.

The past four decades have also expanded the definition of what value means. As markets have matured and expectations of corporate responsibility have broadened, so too has our understanding of the factors that drive long-term performance. Today, sustainability and governance are part of that equation, as practical considerations of risk, resilience, and reputation.

AVI’s 40th anniversary is therefore not a milestone of reinvention, but of continuity. It marks four decades of doing what we have always done: applying disciplined analysis, engaging with purpose, and investing with patience. In a world where trends and terminology come and go, the constant that defines AVI is, and always has been, clarity of thought and conviction in value. It turns out that patience may not always be fashionable, but it has proved rather effective.

Figure 1. Through the Decades Market AGT Timeline (1985-2025)

Source: AVI ESG Internal Database.

Figure 2. AJOT Market Timeline (2018-2025)

Source: AVI ESG Internal Database.

From the outset, AVI’s approach has been guided by a simple conviction: the market often misprices complexity. When AVI assumed management of what is now AGT in 1985, our goal was to exploit those inefficiencies; to look through corporate structures, balance sheets, and ownership layers to find the value others overlooked.

That philosophy took shape through a distinctive investment universe: family-controlled holding companies, closed-end funds, and asset-backed businesses trading at discounts to their underlying value (Figure 3.). These companies tend to share certain characteristics like high-quality assets, and long-term stewards of capital; yet their complexity, limited research coverage, or cross-holdings often cause them to trade below their intrinsic worth. For patient investors, those inefficiencies represent enduring opportunity[2].

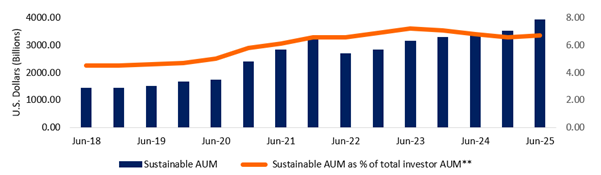

Over four decades, this framework has proved remarkably resilient. It has delivered consistent long-term performance through multiple market regimes: inflationary shocks, technology booms, credit cycles, and more recently, the rise of stewardship and sustainability (Figure 4.). Since 1985, AGT has compounded NAV at approximately +11.5% per annum, outperforming global equity indices (such as the MSCI ACWI) over the same period (Figure 1.).

Our approach has always been bottom-up and research-driven, focussed on understanding what a company owns, how it allocates capital, and who controls it. In recent years, that lens has broadened to incorporate environmental, social, and governance (ESG) considerations; not as a new philosophy, but as an enhancement of the same analytical discipline that has guided us since inception. Assessing governance quality, shareholder alignment, and capital discipline has long been integral to our process; today, evaluating how companies manage environmental and social risks simply extends that logic.

Figure 3. AGT 2024 Investment Universe and ESG Integration

Source: AGT Annual Report 2024.

In 2021, we formalised firm-wide ESG integration as we hired our first dedicated ESG analyst and became signatories to the United Nations Principles for Responsible Investment (UN PRI). Together, these steps marked an important milestone in embedding sustainability more systematically into our research and engagement processes. Environmental mismanagement, weak social practices, or poor disclosure can represent the same kind of hidden liability that a mispriced balance sheet once did. Conversely, sound governance, prudent risk oversight, and responsible resource use can be powerful indicators of sustainable value creation; qualities that we have always sought to identify and hold.

A long history of investing alongside family shareholders has also shaped our thinking about sustainability. Families tend to think in generations, not quarters; they reinvest rather than trade, and they view reputation as a form of capital[3]. That alignment of interests resonates with our own philosophy of patient, active ownership. Where alignment is absent, we engage privately, to help boards act in the long-term interests of all shareholders.

The result is a strategy that has evolved with markets and methodologies, integrating new dimensions of analysis while remaining grounded in the same foundation: a belief that value endures where others see complexity, and that disciplined, responsible ownership is the most sustainable force in capital markets.

Longevity in investing depends as much on adaptability as on discipline. Since 1985, AVI has navigated four decades of structural change in markets – and has adapted our methods without diluting our philosophy. Each period has demanded different tools, but the objective has remained constant: to identify undervalued, under-researched, and often misunderstood businesses, and to act as a catalyst for unlocking their value.

The 1980s and 1990s were shaped by structural inefficiency. Family-controlled conglomerates and closed-end funds across Europe traded at persistent discounts to their underlying assets. Capital markets were less integrated, disclosures thinner, and index investing in its infancy[4]. At AVI’s inception, there were several French holding companies that had complex cascade structures that attracted discounts upon discount. This created the perfect environment for a specialist manager focused on transparency, structure, and governance.

Through the 2000s and 2010s, capital became more global and governance standards began to converge. The adoption of Stewardship Codes in the UK (2010) and Japan (2014), the rise of shareholder engagement, and the growing professionalisation of boards changed the nature of inefficiency. Information asymmetry declined, but misaligned incentives, inefficient balance sheets, and undervalued assets remained. AVI evolved by engaging more directly with company boards and management teams, using analysis not just to identify value but to help realise it. Constructive engagement, often behind the scenes and always grounded in data, became a defining feature of our process.

The most recent decade has brought another inflection point. Markets now assess companies not only on financial returns but also on how they manage broader risks, ESG-related. These factors have proven material to capital allocation, cost of capital, and long-term resilience. For AVI, integrating ESG analysis from 2021 onwards was a natural extension of the same value discipline: understanding all drivers of sustainable intrinsic value.

We do not view sustainability as a separate strategy but as an enhancement of analytical precision. Governance remains the anchor, because effective oversight determines whether environmental and social policies translate into durable performance. Similarly, environmental and social assessments have become another layer of risk evaluation, complementing our traditional analysis of balance sheets, ownership, and capital discipline.

This evolution is visible across our strategies. Our engagement priorities now often include board composition, disclosure standards, and capital efficiency; areas where governance reform and sustainability intersect. In Japan, for example, our work with companies such as SK Kaken reflects this dual focus: unlocking trapped value through governance reform while encouraging more transparent, efficient, and sustainable corporate practices.

The integration of ESG considerations has also formalised aspects of our culture that were long embedded, such as stewardship, accountability, and long-term partnership. What has changed is the framework: clearer metrics, structured reporting, and a systematic assessment of how these factors affect valuation. This evolution strengthens rather than alters the investment philosophy that has guided AVI for forty years.

Markets will continue to evolve, and definitions of “sustainability” may shift again. But the lesson of the past four decades is that adaptation, when anchored in principle, compounds over time. AVI’s long view has always been about continuity, a consistent process refined by new insight, not replaced by it.

Figure 4. Rise of ESG Materiality for Global Investors*

Source: Morgan Stanley Institute for Sustainable Investing.

* AGT is an ESG integrated, not focused, fund; Figure 4 is used as an illustration of sustainable fund AUM growth over the time period.

** % compares between sustainable and ‘Traditional’ funds from a universe of 99,000 global funds, ”Sustainable” uses Morningstar’s definition.

Japan: Governance, Reform, and Resilience

Japan represents both continuity and renewal within AVI’s history. We first invested in Japanese equities in the 1980s as part of our global mandate, attracted by strong balance sheets, high-quality assets, and low valuations. For many years, however, structural barriers such as cross-shareholdings, limited disclosure, and cautious corporate cultures restricted the ability of investors to unlock value.

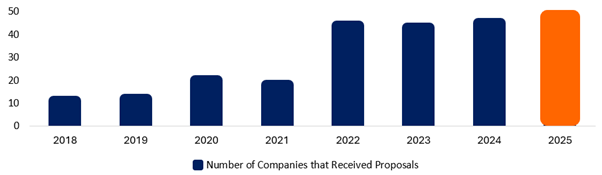

That landscape has changed profoundly. Over the past decade, Japan has undertaken one of the most ambitious governance reform programmes in the world. The Corporate Governance Code (2015), the Stewardship Code (2014) and 2020 revisions have together created the conditions for genuine reform. Cross-shareholdings have almost halved since 2015; and buybacks reached record levels in 2024, and proposals from activist shareholders have quadrupled since 2018 (Figure 5.) – underscoring the pace of governance reform. These developments have made governance and capital allocation leading catalysts for long-term value creation in the market.

Figure 5. Proposals from activist shareholders in Japan *

Source: Mitsubishi UFJ Trust and Banking.

* The 2025 figure is as of June 6th 2025.

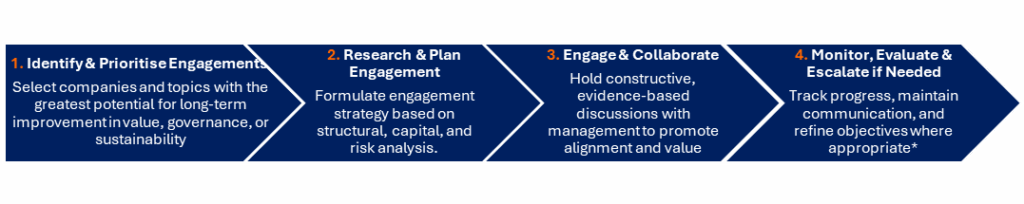

AVI recognised the scale of this opportunity early. Having invested in Japan for decades, we launched a dedicated Japan strategy in 2018 to capitalise on these structural tailwinds. The strategy applies the same principles that define AVI globally: intensive research, engagement with management (Figure 6.), and disciplined valuation; to a market where inefficiency remains abundant.

Our engagement work in Japan illustrates how governance reform and sustainability increasingly intersect. At Toyota Industries, we have long encouraged unwinding of cross-shareholdings and improved capital discipline, recommendations that culminated in 2025 with the reduction of its stake in Aichi Corp from 52 to 20 per cent. At Rohto Pharmaceutical, we combined traditional governance analysis with a broader ESG perspective, highlighting how stronger independent oversight and clearer sustainability disclosure could unlock both financial and reputational value. The case demonstrated how integrating ESG considerations into engagement can strengthen the investment thesis rather than sit apart from it.

Figure 6. Example AVI Engagement Process

* Public campaigns are always a last resort.

For AVI, the Japanese experience demonstrates that sustainability is not confined to environmental metrics; it also resides in governance structures that endure, efficient use of capital, and alignment between owners and stakeholders. As reform momentum continues, we expect Japan to remain one of the richest grounds for long-term, responsible value creation.

Forty years after AVI’s founding, the investment landscape continues to evolve at unprecedented speed. Technology has shortened cycles, regulation has multiplied, and information is now almost frictionless. Yet as markets become more efficient in some respects, they remain inefficient in others; particularly where complexity, ownership, or stewardship obscure intrinsic value. These inefficiencies are AVI’s enduring terrain.

The next chapter will be defined not by a change in philosophy, but by its continued application to a changing world. Across our Global and Japan strategies, the same long-term discipline applies: identifying quality assets trading at discounts to their true worth, engaging constructively where alignment can be improved, and integrating broader sustainability factors that determine durability of value. The analytical tools may become more advanced and disclosure more data-driven, but the essence of what we do remains the same: patient, fundamental investing guided by long-term discipline.

Looking ahead, we see several themes shaping long-term opportunity. First, governance and capital allocation remain amongst the most powerful levers for value creation. As regulatory standards rise and stewardship codes mature globally, we expect investors who can analyse and influence governance quality to continue to generate excess returns. Second, sustainability integration will increasingly distinguish companies able to adapt to environmental and social pressures from those that cannot. This is not an ideological shift, but an economic one: sustainability, properly understood, is about risk, resilience, and responsible capital use – the same elements that have underpinned AVI’s philosophy for decades.

Third, transparency and alignment will become even more critical as ownership becomes more dispersed, and stakeholder expectations rise. Our experience as active owners, engaging with management teams and family shareholders across markets, positions us well to navigate this next phase.

Internally, our focus is on deepening integration rather than broadening scope: refining our ESG analytics, expanding our engagement data systems, and enhancing our reporting transparency. These developments are not about reinvention, but precision and ensuring that our stewardship continues to be informed, credible, and effective. The discipline that has defined AVI’s first forty years will continue to guide our next: rigorous research, constructive engagement, and a clear understanding of what drives long-term value.

As we look forward, we remain conscious that the role of a long-term investor extends beyond analysis. It is about stewardship, ensuring that capital supports companies capable of sustaining value responsibly across cycles and generations. The most durable advantage in markets is not speed or scale but clarity of purpose. Beyond Japan, markets such as Korea are now exhibiting similar structural inefficiencies and reform dynamics, a reminder that the global opportunity set for governance-driven value investing continues to expand.

Trends, terminology, and regulation will continue to evolve; investment fashions will rise and fade. But the principles of discipline and patience that have endured for four decades, are precisely those best suited to the decades ahead. In that sense, the next chapter of AVI is not new at all. It is the same story, written for a new era of value, stewardship, and sustainability; proving that patience ages better than most investment fashions.

Ben Levy, ESG Analyst at Asset Value Investors

November 2025

[1] Anna Tilba, The evolution of investor stewardship and the importance of aligning stewardship metrics, targets and outcomes, 2024.

[2] Asset Value Investors. Family Holding Companies Whitepaper: Keeping it in the Family, 2023.

[3] PwC. PwC’s 12th Family Business Survey Reclaiming advantage, 2025.

[4] Vanguard. Vanguard in a nutshell, 2025.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU. AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

To the extent that material on this website is issued in the UK, it is issued for the purposes of the Financial Services and Markets Act 2000

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website. The information on this website is subject to change without notice.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

This website is primarily intended for United Kingdom (“UK”) residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution, publication or use would be contrary to local law or regulation or in which AVI does not hold any necessary licence or registration. Individuals or entities in respect of whom such prohibitions apply, must not access or use the AVI website.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied.

Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility and liability for the content on third party sites.

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error. You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange. Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting your investment.

Applications to invest in AVI Global Trust referred to on this website, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents.

If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

The content of this website is issued by Asset Value Investors Limited (“AVI”), 2 Cavendish Square, London W1G 0PU.

AVI is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”) and is a registered investment adviser with the Securities and Exchange Commission of the United States. While the Investment Manager is registered with the SEC as an investment adviser, it does not comply with the Advisers Act with regard to its non-U.S. clients.

Intended Audience

The information on this website is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced on this website.The information on this website is subject to change without notice.

This website is primarily intended for UK residents. It is not intended for distribution to, or use by, any U.S. persons or persons in any other country where such distribution or use would be contrary to local law or regulation.

It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

No Tax or Legal Advice

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

Money Laundering

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Full details are contained in the relevant subscription documents.

Investment Decisions

As with all financial or investment matters, you should exercise great care in using the information provided on this website or available through links from this website. You should research the facts, opinions and strategies mentioned in this website before making any financial investment decisions. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

No Warranty; Limitation on Liability

Whilst all reasonable care has been taken in the preparation of this website, AVI cannot guarantee the accuracy or completeness of such information, either expressly or implied. Neither AVI, any of its directors, officers or employees, nor any third party vendor, will be liable or have any responsibility of any kind for any loss or damage that you incur in the event of any failure or interruption of this site, or resulting from the act or omission of any other party involved in making this site or the data contained therein available to you, or from any other cause relating to your access to, inability to access, or use of the site or these materials, whether or not the circumstances giving rise to such cause may have been within the control of AVI, or of any vendor providing software or services support.

All information and content on this website is, subject to applicable statutes and regulations, furnished “as is”, without warranty of any kind, express or implied, including but not limited to implied warranties of merchantability, fitness for a particular purpose or non-infringement. We make no warranty as to the operation, functionality or availability of this website, that the website will be error-free or that defects will be corrected.

In no event shall AVI be liable to any indirect, incidental, special or consequential damages arising out of or in connection with the use of this website, the inability to use this site or any products or services obtained or stored in or from this website, whether based on contract, tort, strict liability or otherwise. These limitations also apply to any third party claims against users.

Intellectual Property

Everything on this website is the valuable intellectual property of Asset Value Investors Limited, or their respective suppliers. We protect our intellectual property rights to the full extent of the law.

Copyright Policy

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Hyperlinks

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party sites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party sites. AVI reserves the right to require written consent for, or request the removal of, any links to our website.

AVI disclaims all responsibility for the content of third party sites

Security

For your protection, we require the use of encryption technologies for certain types of communications conducted through this website. While we provide those technologies and use other reasonable precautions to protect confidential information and provide suitable security, we do not guarantee or warrant that information transmitted through the Internet is secure, or that such transmissions will be free from delay, interruption, interception or error.

You acknowledge and agree that users of this website and users, owners, or managers of third party websites may not: (i) collect or store personal data about other users of this website or (ii) upload, e-mail or otherwise transmit any material that contains viruses or any other computer code, files or programs that might interrupt, limit or interfere with the functionality of any computer software, hardware, database or file, or communications equipment that is owned, leased or used by AVI.

Privacy Policy

We encourage you to read AVI’s Privacy Policy which can be obtained by clicking the Privacy Policy button found on the Homepage.

General Terms

Deliberate misuse of any element of this website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

You shall indemnify us from and against all actions, claims, proceedings, costs and damages (including any damages or compensation paid by us on the advice of its legal advisors to compromise or settle any claim) and all legal costs or expenses arising out of your use of this website, any breach of any applicable law, statute, ordinace, regulation or third party rights and any breach by you of the software licenses and service agreements governing the software made available to you in connection with this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations.

AVI Global Trust – General Risk Factors

AVI Global Trust plc is a public company listed and traded on the London Stock Exchange.

Past performance should not be seen as an indication of future performance. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. The trust uses gearing techniques (leverage) which will exaggerate market movements both down and up which could mean sudden and large falls in market value. Please refer to the Key Features Document for further details effecting affecting your investment.

Applications to invest in AV Global Trust referred to on this Site, must only be made on the basis of the current Key Features Document, or other applicable terms and conditions. Past performance should not be seen as an indication of future performance. Market and exchange rate movements may cause the value of a fund to rise or fall and an investor may not get back the amount invested.

As a result of money laundering regulations, additional documentation for identification purposes may be required when you make your investment. Details are contained in the relevant application documents. If you are unsure about the meaning of any information provided please consult your financial adviser or other professional adviser.

By agreeing to these terms, you agree that we may contact you by post, fax, email, SMS messaging or by other forms of electronic media to inform you of our products and services that we believe you might be interested in.

INVESTOR – Risk Warnings

It is very important that you read this warning and disclaimer before proceeding, as it explains certain legal and regulatory restrictions applicable to any investment services and products we provide.

The content of this website is issued by Asset Value Investors Ltd (“AVI”), 2 Cavendish Square, London W1G 0PU

AVI is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom.

This website is not directed at any person in any jurisdiction where it is illegal or unlawful to access and use such information. AVI disclaims all responsibility if you access any information in breach of any local law or regulation. All persons who access this website are required to inform themselves and to abide with all applicable local law, regulations and restrictions.

The information on this website is not directed at any person or entity in the United States, and this site is not intended for distribution or to be used by any person or entity in the United States unless those persons or entities are existing investors in funds managed by AVI and they have applicable US exemptions.

Nothing on this website constitutes investment, legal, tax or other advice nor should it be relied upon in making an investment decision.

The funds referred to in this website are alternative investment funds (“AIFs”). The promotion of such funds and the distribution of offering materials in relation to such funds is accordingly restricted by law.

Shares in the funds mentioned in this website are not dealt in or on a recognised or designated investment exchange, nor is there a market maker in such shares, and it may therefore be difficult for an investor to dispose of his shares.

The information on this website is neither an offer to sell nor a solicitation of any offer to buy shares in any fund managed by AVI.

An application for shares in any of the funds referred to on this site should only be made having fully read the relevant prospectus and most recent financial statement and semi-annual financial statements published thereafter.

The Information is provided for information purposes only and on the basis that you make your own investment decisions and do not rely upon it.

AVI is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.

Should you have any queries about the investment funds referred to on this website, you should contact your financial adviser.

Past performance is not an indication of future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested.

The funds noted in this website may be subject to higher risk and volatility than other funds and may not be suitable for all investors. These funds are not regulated.

Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

The levels and bases of and reliefs from taxation may change. Any tax reliefs referred to are those currently available and their value depends on the circumstances of the individual investor. Investors should consult their own tax adviser in order to understand any applicable tax consequences.

The information on this website, including any expression of opinion or forecast, has been obtained from, or is based on, sources believed by AVI to be reliable, but are not guaranteed as to their accuracy or completeness and should not be relied upon.

You should be aware that the Internet is not a completely reliable transmission medium. AVI does not accept any liability for any data transmission errors such as data loss or damage or alteration of any kind, including, but not limited to any direct, indirect or consequential damage, arising out of the use of the products or services referred to herein. This does not exclude or restrict any duty or liability that AVI has to its customers under the regulatory system in the United Kingdom.

To make a complaint about this website ,please send a written complaint for the attention of the Compliance Officer at the registered address: 2 Cavendish Square, London W1G 0PU.

You agree to indemnify, defend, and hold harmless AVI, its affiliates and licensors, and the officers, partners, employees, and agents of AVI and its affiliates and licensors, from and against any and all claims, liabilities, damages, losses, or expenses, including legal fees and costs, arising out of or in any way connected with your access to or use of this website and the Information.

The existence of hyperlinks should not be construed as an endorsement, approval or verification by AVI of any content available on third party websites. By providing access to other websites, we are not recommending the purchase or sale of products or services provided by the website’s sponsoring organization. We do not review any of these third party websites.

No permission is granted to copy, distribute, modify, post or frame any text, graphics, video, audio, software code, or user interface design or logos.

Nothing on this site should be considered as granting any licence or right under any trademark of AVI or any third party.

Deliberate misuse of any element of this Website including, without limitation, hacking, introduction of viruses or similar code, disruption or excessive use or any use in contravention of applicable law, is expressly prohibited and we reserve the right to terminate your access to the Website, and at our discretion, pass information to the legal authorities.

We reserve the right at any time on giving notice to change or modify these terms and conditions or to impose new conditions in respect of this website or to change or discontinue any aspect or feature of this website. We shall be entitled to terminate your access to this website at any time on giving notice to you and in any event if you commit any breach of these terms and conditions. We shall have no liability to you for such termination. Notices may be served by any reasonable method including posting on this website.

These terms and conditions shall be governed by and construed in accordance with the laws of England without regard to conflicts of law principles. Nothing in these Terms and Conditions will exclude or restrict any duty or liability we may have under applicable rules or regulations. You irrevocably waive any right to a jury trial in any dispute or proceeding arising from the use of this site.